This allows you to use your policy health card to receive treatment without having to pay out of pocket. Enjoy peace of mind knowing your health is covered without the hassle of upfront payments.

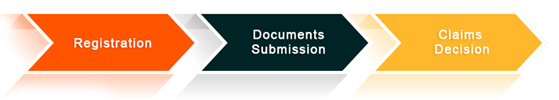

We are pleased to introduce PolicyX's streamlined cashless claim process, designed to make your claims experience effortless. With the support of our dedicated Helpdesk, you can navigate through the process in just below simple steps:-

-

Claim Intimation & Registration

Simply Intimate your claim to the Insurance company or to your Adviser on call at 1800-4200-269 /email-(Helpdesk@policyx.com). you Can intimate your hospitalisation with few simple details about you admission.

- Patient Name

- Date of Admission

- Hospital Name & Address

- Diagnosis/ Illness

- Estimated Claimed Amount

-

Documentation

Simply submit your Documents at Hospital’s TPA Desk & Apply the Cashless claim. Below Documents required to Apply the Cashless Claims.

- Pre-Authorisation form (To be filled by the Hospital)

- Date of Admission

- Cashless Policy health card

- ID Proof

- Medical Reports with Dr’s Prescription

-

Claim Decision (Approval)

Wait for the Approval from insurer side, Standard time for decision on claim is Minimum 2 Hrs Maximum. In case you feel delay in approval you can contact us to fast Settlement.

We are pleased to introduce PolicyX's streamlined reimbursement claim process, designed to simplify your claims experience. For reimbursement claims, you pay for your treatment upfront and then submit your invoices to the insurance company to get reimbursed for your expenses. With the assistance of our dedicated Helpdesk, you can effortlessly navigate through the process in just a few simple steps.

-

Claim Intimation & Registration

Simply Intimate your claim to the Insurance company or to your Adviser on call at 1800-4200-269/email-(Helpdesk@policyx.com). you Can intimate your hospitalisation with few simple details about you admission.

- Patient Name

- Date of Admission

- Hospital Name & Address

- Diagnosis/ Illness

- Estimated Claimed Amount

-

Documents Submission

You can file the claim either online or offline by submitting the claim documents to the insurance company. For any assistance, kindly refer to the helpdesk matrix below. We are here to help ensure a hassle-free claim settlement experience. Connect with your Advider (PolicyX Team) at (1800-4200-269) Or 24*7 Matrix you can send an Email at Helpdesk@policyx.com for claim intimation within 24 hrs of Hospitalization.You can download the Claims Form for your respective Health Insurance policy. Typically these Documents are required to be submitted:-

- Claim form duly signed (Claim form Part-A & Part-B)

- Copy of patient’s photo ID card

- Hospital Discharge Summary and Operation Theatre notes/ICP papers

- Hospital Bills including break-up of the bills

- Payment receipts

- Investigation reports including CT/XRAY/MRI/USG/HPE reports

- Pharmacy bills

- Personalised Cancelled Cheque with the name of “Proposer”

-

Claims Decision

Based on the policy T&C decision will be taken for the claims, Below are the deicions can be taken based on below conditions.

Claim Approved - if Diagnosis covered in policy and complete documents submitted to the insurance company.

Claim Query/Deficiency Raised - if incomplete documents submitted insurance company can raise the requirement for additional documents to process the claim.

Claim Investigation - if Insurance company want to verification of the claim, they can initiate the investigation to check Genuinity Or rule out the PED (Pre existing disease).

Claim Rejection - Insurance Company can reject the claim in below conditions. we need to take care of the things. refer Annx. “Claim Rejection”

PolicyX.Com is a Platinum partner for most large Health Insurance companies, and India’s Growing Insurance Service Provider Intermediatary), Serving Best claims services everyday 24*7, And our Target to get the customer’s smily as a review. As a result, we are able to provide the best possible support on your Claim:-

-

Fast Claim Settlement – We will ensure that your claims are settled on top most priority from the insurer, does matter request raised in working or non working hours.

-

Two way communication with the Insurer – PolicyX’s helpdesk team works closely with all Insurance companies and we will ensure that claims are smooth, fast and hassle free. We will navigate through the documents, forms, queries on your behalf, and get you out of the Hospital as soon as possible.

-

Live Update on Claim Movement – We will keep you posted at every stage of your claim from Claim Initiation to Approval and your Discharge. We help you navigate through complicated documents and emails.

-

Advance Approvals for Claims – We support our valauble customers for Advance approval for cashless hospitalization for smothly and hesslefree treatment.

-

Dedicated Claims Support team – You will be receiving your personal claim handler from our team of claim experts to handle your end-to-end claim related queries and provide assistance for a hassle-free claims experience.

-

Our Vision- Customer’s Smile - We always targeting our customer to share their positive review regarding claims experience, Infact it is our Mission as well as Vision to make our HAPPY.

-

24*7 Customer Support With Dedicated Relationship Team - We Serve our customers 24*7 with dedicated relation matrix, where our customers have complete dedicated relationship team to end to end support in term of Policy Purchase, Policy renewal, Endorsement services, claims services, Claims reconsideration, Health checkup services, etc.