- Secure Yourself from Uncertainties

- Explore All the Plan Variants

- Inclusions & Exclusions

Buy Policy in just 2 mins

2 lakh + Happy Customers

Free Comparison

Health and Term Insurance

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto is to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Health Insurance

Raj Kumar has more than a decade of experience in driving product knowledge and sales in the health insurance sector. His data-focused approach towards business planning, manpower management, and strategic decision-making has elevated insurance awareness within and beyond our organisation.

Updated on Apr 08, 2025 4 min read

Life is uncertain, and any contingency such as any critical illness or accidents can disrupt your happiness adversely and can wipe off all your hard-earned savings. Aditya Birla Activ Secure has designed 4 different plans that let you plan to overcome any such situations in life.

The four different plans offered under Aditya Birla Activ Secure are:

Continue reading to explore how these plans can help you:

This plan protects you and your family from any contingencies arising due to an unfortunate accident. With Aditya Birla Activ Secure - Personal Accident, you can secure yourself and your family from the financial implications of deadly accidents.

| Entry Age | 5 years - 65 years |

| Sum Insured | Up to 12% times more than the gross income of an earning member. |

| Emergency Road Ambulance Cover | Covered |

| Funeral Expenses | Covered up to 1% of Sum Insured, maximum up to Rs. 50,000 |

| Repatriation of Remains | Covered up to Rs. 50,000 |

| Orphan Benefit | Available 10% of Sum Insured, maximum up to 15 Lakhs |

| Modification Benefit | Available up to Rs. 1 Lakhs |

| Compassionate Visit | Covered Domestic Travel: up to Rs. 10,000 International Travel: up to Rs. 25,000 |

| Optional Covers Available | Temporary Total Disablement (TTD) Accidental in-patient Hospitalization Cover Broken Bones Benefit Coma Benefit Burn Benefit Accidental Medical Expenses Adventure Sports Cover Worldwide Emergency Assistance Services EMI Protect Loan Protect Wellness Coach |

Any claims arising directly or indirectly out of the following causes are excluded under the Activ Secure - Personal Accident Plan:

Besides the physical and emotional distress that a critical illness causes, the treatment of such illnesses can drain off your financial stability. However, protecting your family emotionally and financially in such situations is mandatory. Now, with the Activ Secure - Critical Illness plan, you can backup your treatment expenses in case you are diagnosed with a critical illness.

The plan comes in three variants

Plan 1: Covers 20 Critical Illnesses such as cancer, heart attack, kidney failure.

Plan 2: Covers 50 Critical Illnesses such as brain surgery, benign brain tumour, TB in addition to the 20 critical illnesses covered under plan 1.

Plan 3: Covers 64 Critical illnesses and procedures like angioplasty, pacemaker insertion, and hysterectomy in addition to the 50 critical illnesses covered under plan 2.

| Entry Age | 5 years for Plan 1 & Plan 2 18 years for Plan 3 |

| Sum Insured | Up to 12% times more than the gross income of an earning member. |

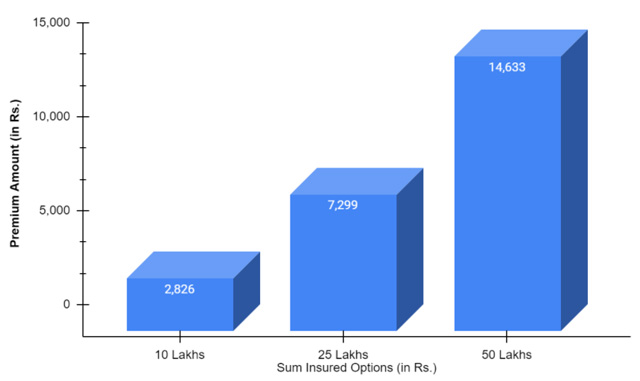

Let’s assume, Mr Vinay, a 30-year-old individual, with a family history of critical illnesses such as cancer and kidney failure decides to buy the Activ Secure - Critical Illness Plan. Now, let’s see how much premium amount he needs to pay for different sum insured options.

Graph Illustrating the Premium Amount Payable Under Activ Secure - Critical Illness

In case of hospitalization, apart from the treatment cost, there are other miscellaneous expenses such as travelling to and fro the hospital, expenses of the attendant, and post-discharge expenses, etc. With Activ Secure - Hospital Cash, such expenses are covered.

Cancer... a name that itself is enough to give you chills down the spine. And if, god forbid, it happens to you or your loved ones, are you financially prepared to tackle it? With Activ Secure - Cancer Secure, you can ensure that even if you or any of your family members get diagnosed with early, major, or advanced-stage cancer, you have a financial backup to pay for the treatment so you can easily focus on recovery without worrying about the expenses.

| Age | 18 years - No age limit |

| Sum Insured |

|

The plan offers payouts according to different stages of cancer. Refer to the below-mentioned table to know the limits:

| Early Stage | 50% of the sum insured |

| Major Stage | 100% of sum insured |

| Advanced Stage | 150% of sum insured |

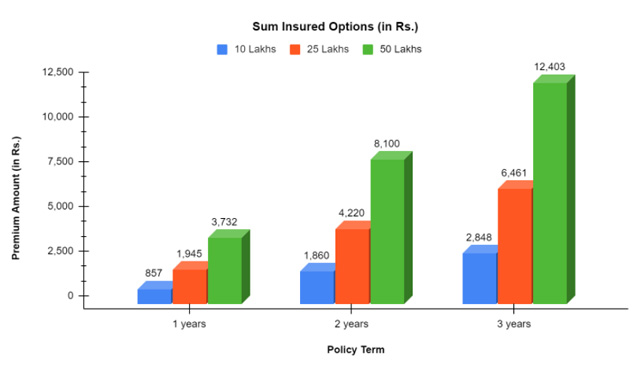

Let’s assume, Mr Ajay, a 30-year-old individual, with a family history of cancer, decides to buy Activ Secure - Cancer Secure Plan for himself. Now, let’s see how much premium amount he needs to pay for different sum insured options.

| Policy Term | 10 Lakhs | 25 Lakhs | 50 Lakhs |

| 1 year | 857 | 1,945 | 3,732 |

| 2 years | 1,860 | 4,220 | 8,100 |

| 3 years | 2,848 | 6,461 | 12,403 |

Graph Illustrating The Premium Amount Payable Under Activ Secure - Cancer Secure

Buying Aditya Birla Activ Secure online is a hassle-free process. Follow the below-given steps to understand the whole process:

Step 1: Visit the official website of Aditya Birla Activ Health.

Step 2: From the top menu bar, click on the products, and then select Activ Health Secure from the drop-down menu.

Step 3: Click on the variant you want to choose.

Step 4: Go to the ’Quick Quote’ option, and fill up your details in it.

Step 5: Once done, the next page will show you all the details related to the premium you need to pay. You can choose the policy term, sum insured, and can also add other family members.

Step 6: Click on the ’Buy Now’ option, and pay the premium online. Your policy details will be shared at your registered email address.

You can also buy it from PolicyX. Below is its buying process.

Cashless Claim

Reimbursement Claim

If you are admitted to a non-network hospital, you have to pay the hospital directly after the treatment is done.

Note- You need to inform the company within 48 hours (in case of emergency hospitalization) and 3 days before your admission (for planned hospitalization).

Aditya Birla Health Insurance Network Hospitals are present in 31 states nationwide. With a wide network of hospitals, Aditya Birla Health Insurance ensures that you are medically secured, irrespective of the city you reside in.

Aditya Birla Health Insurance

Aditya Birla Activ Secure

To cater to the different medical needs of an individual & their family, Aditya Birla Health Insurance offers several Health Plans ranging from senior citizen plans to specialized plans for autistic children, to health insurance for cardiac patients, and many more.Take a look below to Aditya Birla Health Insurance plans explore more:

Individual and Family Health Insurance

A plan designed for every lifestyle. What if I told you that there is a health insurance plan that gives coverage according to your lifestyle? Yes, Ad...

Unique Features

Individual and Family Health Insurance

A plan that covers you and your extended family. Imagine getting a health insurance plan for you and your family. With family, I mean: Your spouse ...

Unique Features

Individual and Family Health Insurance

Aditya Birla Activ Health Platinum Essential Plan is your best friend if you are looking for a health insurance cover that protects you against chroni...

Unique Features

Individual and Family Health Insurance

Activ Health Platinum, a health product by Aditya Birla Health Insurance Company is a health insurance plan designed to look after the healthcare need...

Unique Features

Top Up and Super Top Up

Is there a health plan that covers exceeding medical expenses without letting you worry about its limit? Well, Aditya Birla Activ Assure Diamond does!...

Unique Features

Individual and Family Health Insurance

Isn't it right to have a health insurance policy that provides all-time healthcare accessibility for you and your family and doesn't drain out your al...

Unique Features

Individual

When you have access to everything global, why should your healthcare be any different? To cater to your global healthcare services requirements, the ...

Unique Features

Individual and Family Health Insurance

Raho Fit to Get Benefits! Ye hai #FitnesskaUltimateInfluencer You can earn with the Aditya Birla Activ Fit Plus plan and become wealthy! YES, you hear...

Unique Features

Senior Citizen Health Insurance

What if someone looked after your parents just like you?' Aditya Birla's Active Care Standard plan does that for your parents. This is one of the plan...

Unique Features

Individual and Family Health Insurance

The Activ Health Platinum Premiere plan is one of the variants of the Aditya Birla Activ Health insurance plan. It safeguards you from health emergenc...

Unique Features

Individual and Family Health Insurance

Aditya Birla Activ One Plan comprises features such as: Health returns Health assessment Daycare treatments No capping on hospitalization expenses Me...

Unique Features

Senior Citizen Health Insurance

Growing old comes with several complications related to our health, at times. It's so natural that nobody could deny accepting the complications and s...

Unique Features

Critical Illness Health Insurance

Aditya Birla Activ Secure Critical Illness Plan is designed to cover your financial losses due to any treatment for critical illness. The plan has wid...

Unique Features

Individual and Family Health Insurance

Aditya Birla Activ Fit Plan is designed to provide quality medical coverage to young individuals. The plan not only provides medical coverage but als...

Unique Features

Individual and Family Health Insurance

Aditya Birla Platinum Enhanced Plan offers unique healthcare benefits to insured individuals such as health insurance protection with wellness benefit...

Unique Features

Accident Health Insurance

Aditya Birla Activ Secure Personal Accident Plan is designed to protect you and your family in case of any unforeseen incident. Activ secure personal ...

Unique Features

Critical Illness Health Insurance

Aditya Birla Cancer Secure health plan is a health insurance plan designed specifically for cancer patients protecting them financially from all three...

Unique Features

The Activ Secure plan is a comprehensive health insurance policy designed to provide financial protection against medical expenses.

The eligibility criteria for the Activ Secure plan typically include age, occupation, and health status. However, specific eligibility requirements may vary depending on the insurance provider.

The Activ Secure plan generally offers benefits such as in-patient hospitalization, pre- and post-hospitalization expenses, day care treatment, ambulance charges, and optional riders.

Some insurance providers may offer coverage for pre-existing diseases after a specific waiting period, while others may have restrictions or exclusions.

See More Health Insurance Articles

See More Health Insurance Articles

4.4

Rated by 2632 customers

Select Your Rating

Let us know about your experience or any feedback that might help us serve you better in future.

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto is to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

You May Also Know About

✖

✖

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Your call has been scheduled with Policyx for health insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata

Do you have any thoughts you’d like to share?