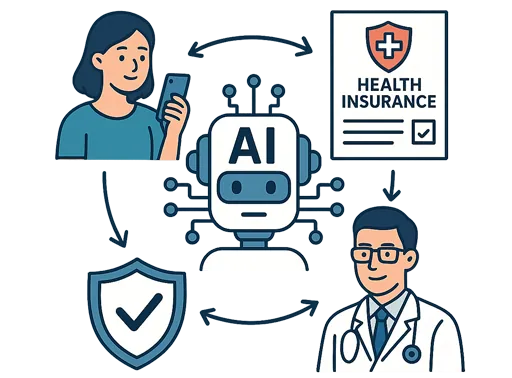

HDFC ERGO Health Insurance

HDFC Ergo Health Insurance has become a popular and trusted name in the insurance sector. They offer exclusive health plans, discounts on diagnostic t...Read More

Network hospitals

12000+

Claim settlement ratio

98.59%

Sum insured

Up to 2 Cr

No. of Plans

12Solvency Ratio

1.7

Pan India Presence

200+

3897-1730103982.webp)

3937-1730269249.webp)

3468-1730263519.webp)

3179-1730197034.webp)

3178-1730184945.webp)

3128-1730267377.webp)

3127-1730201943.webp)

805-1730283766.webp)

786-1730279051.webp)

756-1730276727.webp)

165-1730282469.webp)

Do you have any thoughts you’d like to share?