- Policy specifications

- Affordable premium

- List of Insurance Providers

Buy Policy in just 2 mins

2 lakh + Happy Customers

Free Comparison

Health and Term Insurance

Simran is an insurance expert with more than 4 years of experience in the industry. An expert with previous experience in BFSI, Ed-tech, and insurance, she proactively helps her readers stay on par with all the latest Insurance industry developments.

Insurance & Business

Naval Goel, the founder of PolicyX is a well-recognised name in the Indian insurance and finance industry. His global overview has revolutionised the way insurance is perceived and bought by commoners in India.

Updated on Apr 08, 2025 4 min read

Arogya Sanjeevani policy is a standard health insurance policy, launched by IRDAI on 1 April 2022.

Designed to support individuals and families who are on the lookout for affordable health insurance with a wide range of sum-insured options. The sum insured options available are from INR 1 to 5 Lakhs.

However, insurance providers offer this plan with different modifications and sum insured options.

Arogya Sanjeevani health insurance entry age criteria is 18 to 65 years for adults. Dependent children are covered from the age of 3 months to 25 years.

To find out if Arogya Sanjeevani health insurance is a fit for you, scroll down further.

Take a look at Arogya Sanjeevani Health Insurance Plan essentials

| Entry Age | Minimum: 18 Years Children: 3 Months to 25 Years Maximum: 65 Years |

| Standard Sum Insured | 1 L | 2 L | 3 L | 4 L | 5 L |

| Policy Tenure | 1 Year |

| Riders/ Add-Ons | None |

| Initial Waiting Period | 30 Days |

Here are health insurance companies in India that provide Arogya Sanjeevani Health Insurance policy

| Company Name | Plan | Claim Support (within 3 months) | Maximum Sum Insured (in Rs) | Premium @ Sum Insured 5 Lakhs (in Rs.) |

| Star Health and Allied Insurance Company | Arogya Sanjeevani Policy | 99.9% | 10,00,000 | 4921 |

| ICICI Lombard | Arogya Sanjeevani Policy | 96.93% | 5,00,000 | 5449 |

| Bajaj Allianz General Insurance Company | Bajaj Allianz Arogya Sanjeevani Policy | 98.61% | 25,00,000 | 5320 |

| Reliance General Insurance Company | Reliance Arogya Sanjeevani Insurance Plan | 98.16% | 5,00,000 | 4495 |

| SBI General Insurance Company | Arogya Sanjeevani Health Insurance | 97.84% | 5,00,000 | 4501 |

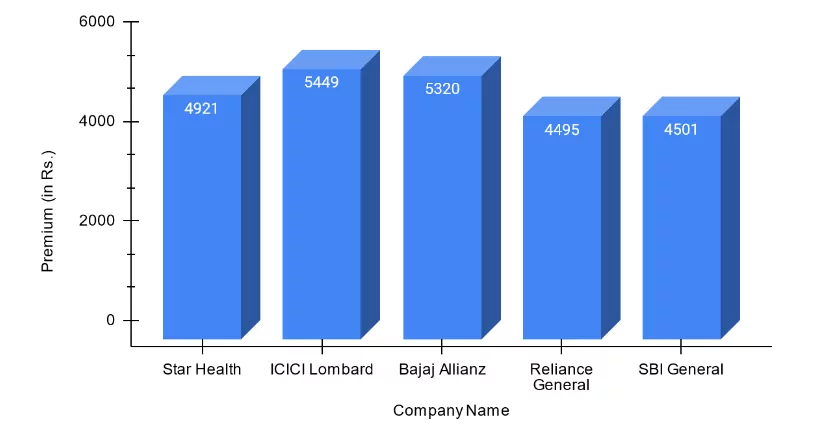

Let's understand the premium rates with the help of a graph.

The belowmentioned graph represents the Premium which is to be paid by a healthy male of 30 years at the Sum Assured amount of Rs. 5 lakhs (for different companies).

Premium payable by an individual under Arogya Sanjeevani Policy

Features associated with Arogya Sanjeevani health insurance are:

A standard health insurance policy, wherein you can choose coverage of up to Rs.1 lac to Rs.5 lacs.

Unique Benefits

A robust policy that takes care of 360-degree health needs for you and your family with a maximum sum assured up to INR 25 lakh.

Unique Features

It is a standard health insurance plan that mainly covers emergency hospitalization, alternative treatment, Inpatient Care and ICU expenses.

Unique Benefits

A standard comprehensive plan mandated by IRDAI that offers coverage for both Ayurvedic or Allopathic treatments.

Unique Benefits

A health insurance plan that offers standard benefits as directed by the IRDAI. The plan offers coverage up to INR 10 Lakhs.

Unique Features

A standard Health plan that offers coverage up to 5 lakhs to the insured & his family. The plan offers you everything you need under a health insurance plan.

Unique Features

It is a standard health insurance plan that offers medical coverage of up to 10 Lakhs. Also, a fixed co-pay of 5% is applicable for all claims and ages in this policy

Unique Features

A standard and affordable health plan that offers medical coverage to individual and their families with a coverage of up to 10 Lakhs.

Unique Features

A standard health insurance plan that comes with a coverage of 10 Lakhs. Moreover, the plan comes with a 5% Co-pay, applicable on all the admissible claims.

Unique Features

A standard health plan mandated by IRDAI that covers all essential healthcare benefits including Ayush treatment, day care procedures, etc. for individuals and families.

Unique Features

A standard health plan designed to cover basic medical needs and keep you and your family protected in case of medical contingencies.

Unique Features

Provides coverage for basic medical expenses, which include hospitalization, and pre and post-hospitalization expenses at affordable prices.

Unique Features

An affordable standard health insurance plan for individuals and family members with up to 10 L SI.

Unique Features

A standard health policy that offers coverage to individuals and their families against medical expenses. The policy offers coverage of up to INR 5 Lakhs.

Unique Features

The standard health insurance plan, which is designed to look after your healthcare needs at affordable premiums.

Unique Features

The plan covers you and your family against new age treatments, pre, and post-hospitalization, and hospital room rent charges.

Unique Features

Arogya Sanjeevani is a standard indemnity-based health insurance product designed to safeguard the medical requirements of customers.

Unique Benefits

A standard health plan that offers complete protection in case of hospitalization due to any serious illness or accident.

Unique Features

It is an all-in-one plan that covers hospitalization and modern treatments. The plan also provides coverage for accidental injuries and pre-existing diseases.

Unique Features

A plan that covers you and your family against the financial risks arising out of medical contingencies and offers the flexibility of paying in multiple frequencies.

Unique Features

Covers hospitalization charges for the individual and family members. It is a standard plan that covers many illnesses and annual medical checkups.

Unique Features

The Policy offers hospitalization coverage from Rs. 50,000 to Rs. 10 lakhs. This coverage is available on an individual and on a family floater sum insured basis.

Unique Features

Standard indemnity health insurance product, having Sum Insured up to 10 Lakhs available in both individuals and floater type.

Unique Features

Here is what you are covered for on purchasing the Arogya Sanjeevani Health Insurance Policy

| Inclusions | Features |

| Pre and Post Hospitalization | Expenses covered before and after hospitalization |

| COVID-19 Cover | You are covered for treatment of COVID-19 |

| AYUSH Cover | Covered for alternative treatments like Ayurveda, Unani, Siddha, and Homeopathy |

| ICU Cover | The policy will cover you for ICU admission as per policy sub-limits |

| Room Rent | Covers room rent for insured individuals till hospitalization |

| Road Ambulance | Road ambulance will be covered for medical emergencies |

| Modern Treatments | Covers modern treatments up to 50% of SI |

| Cataract | Cataract treatment is covered up to 25% of SI or up to INR 40,000 |

The following are the exclusions for Arogya Sanjeevani Health Insurance:

The pros and cons associated with the Arogya Sanjeevani plan are:

| Pros | Cons |

| A simple health plan with basic coverage is offered | No riders available |

| Comprehensive features like AYUSH Treatment, Road Ambulance, Daycare procedures, etc. | A low range of sum insured options is available |

| Upto 50% no-claim bonus available to insurance holders | Various sub-limits on treatments like cataracts and modern treatment |

| Affordable premiums make it a household name | No major ailments are covered |

| Flexible premium payment installment option for policyholders | Compassionate travel unavailable |

| Lifelong renewability option available | Maternity or newborn cover is unavailable |

Arogya Sanjeevani health insurance is an affordable health plan launched by IRDAI. It is designed to meet basic healthcare needs along with COVID-19 coverage.

Arogya Sanjeevani health policy is an attempt to make healthcare policies available to all with a basic sum insured value and all necessary features.

As compared to other health plans, the Arogya Sanjeevani policy is an economical policy and one of the best options for young individuals who have started earning recently.

I. Directly through the Insurer's Website

1

Calculate Premium with Arogya Sanjeevani Premium Calculator

2

Choose the plan as per your requirements

3

Fill the proposal form with the required information

4

Pay the premium online via debit/credit card

5

Arogya Sanjeevani Policy will be issued online

Note: The procedure of buying Arogya Sanjeevani policy varies from company to company. Refer to the company's brochure for more information.

II. From PolicyX.com

1

Fill in all the required details in the 'Calculate Premium' section

2

The next page will show all the available plans

3

Choose the most suitable Health Plan and click on 'Buy Now'

4

Pay the premium online

5

Details will be shared at your registered email address

Claims can be settled in two ways:

Cashless Claim - When you're admitted to a Network Hospital

Reimbursement Claim - When you're admitted to a Non Network Hospital

Cashless Claims

Inform the Insurer about Hospitalization at the earliest.

Submit the requisite forms, Health Card, photo ID at the Hospital Desk.

On approval, the Insurer settles your claim directly with the hospital.

Reimbursement Claims

Inform the Insurer about Hospitalization at the earliest.

Submit original copies of bills to the Insurer within 15 days post discharge.

Once approved, the claim amount shall be transferred to your account.

If you are new to health insurance and are a little confused about which plan is the right one for you, Arogya Sanjeevani health policy is one of the best options.

It is an affordable plan and does not require you to commit for the long term. This health plan is available at every health insurance provider with different variations of sum insured options.

To understand features, inclusions, and exclusions along with the pros and cons of Arogya Sanjeevani health policy refer to this article for a better understanding.

OR

Give a call to our expert advisors at PolicyX and get your queries answered, anytime!

Yes, Arogya Sanjeevani health policy covers COVID-19.

The eligibility criteria for the Arogya Sanjeevani Health Insurance is 18 to 65 years for adults. While dependent children can be covered from 3 months to 25 years.

Refer to the following terms and conditions for cancellation

| Cancellation Type | % of Premium Refunded |

| Up to 30 days | 75% |

| 31-90 days | 50% |

| 3 months - 6 months | 25% |

| 6 - 12 months | 0% |

A 15-day free look period is available under the Arogya Sanjeevani Health Policy.

No, there is no limit on the number of claims one can make under this plan. However, the claims will be admissible only until your coverage is not exhausted.

The policy tenure of Arogya Sanjeevani is for 1 year only.

The policy covers 2 adults (self and spouse) and up to 3 dependent children.

Yes. If you receive treatment at a Network Hospital associated with your Insurance Provider, you can avail Cashless Hospitalization under Arogya Sanjeevani.

The policy covers the room rent up to a maximum of Rs. 5,000 per day, subject to the Sum Insured.

Yes, an NRI can buy Arogya Sanjeevani Insurance. However, before choosing one, you need to contact your insurer as every company comes with different terms & conditions.

No, the plan does not have any riders.

Compare health insurance plans from different companies.

See More Health Insurance Articles

See More Health Insurance Articles

4.4

Rated by 2649 customers

Select Your Rating

Let us know about your experience or any feedback that might help us serve you better in future.

Simran is an insurance expert with more than 4 years of experience in the industry. An expert with previous experience in BFSI, Ed-tech, and insurance, she proactively helps her readers stay on par with all the latest Insurance industry developments.

You May Also Know About

✖

✖

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Your call has been scheduled with Policyx for health insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata

Do you have any thoughts you’d like to share?