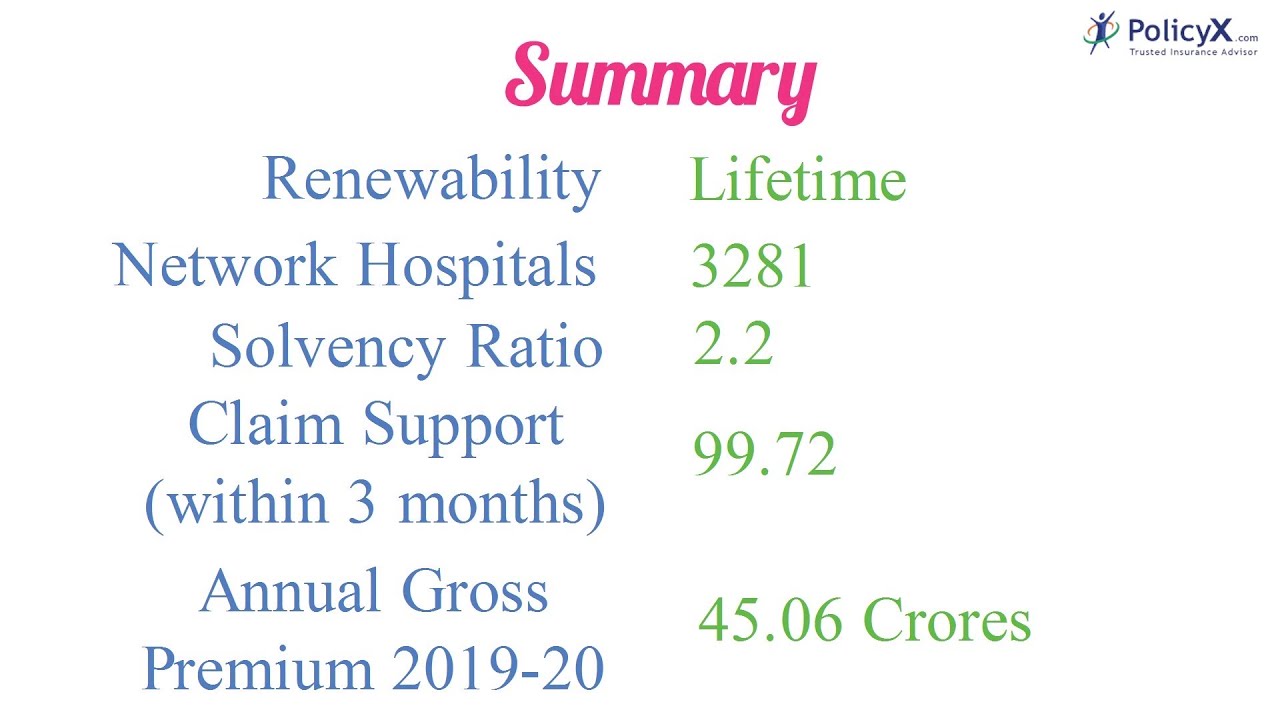

ZUNO Health Insurance

Zuno health insurance is one of the good competitors in health insurance sector. Their plans are affordable yet compatible allowing the policyholders ...Read More

Network hospitals

10000+

Claim settlement ratio

98.54%

Sum insured

Up to 1Cr.

No. of Plans

3Solvency Ratio

1.7

Pan India Presence

9+

Choose 1st Company

Choose 2nd Company

Compare

Best Selling ZUNO Health Insurance Plans

Let's take a look at the list of health insurance plans that offer comprehensive protection to you and your family

-

Individual

ZUNO Health Insurance Plans Eligibility Approximate Annual Premiums Zuno Corona Rakshak Entry Age - 18 to 65 years

Sum Insured - Up to 2.5 LRs. NA

-

Individual and Family Health Insurance

ZUNO Health Insurance Plans Eligibility Approximate Annual Premiums Zuno Corona Kavach Entry Age - 18 to 65 years

Sum Insured - Up to 1 LRs. NA

-

Family

ZUNO Health Insurance Plans Eligibility Approximate Annual Premiums Zuno Arogya Sanjeevani Entry Age - 18 Years

Sum Insured - Up to 5 LRs. NA

Key Features Of ZUNO Health Insurance

Let us take a look at some unique features of top-selling ZUNO Health Insurance policies:

For Individual

Zuno Corona Rakshak

A comprehensive health insurance that provides you with a 100% sum insured lump sum amount on being hospitalised due to COVID-19 for more than 72 hours. It also covers consumables expenses, AYUSH treatment expenses, and more.

Why Do We Recommend This?

- AYUSH cover

- Ambulance cover

- Tax benefit

For Individual and Family Health Insurance

Zuno Corona Kavach

Corona Kavach is a floater health plan designed to cover hospitalization expenses related to COVID-19. It is available for individuals and families. Under the Zuno Corona Kavach policy, you can cover your spouse, dependent children, and parents or parents-in-law.

Why Do We Recommend This?

- Avail add-ons

- Family cover

- Flexible policy tenure

For Family

Zuno Arogya Sanjeevani

Zuno Arogya Sanjeevani health plan is one of the most comprehensive and affordable insurance policies in the market. It was proposed by IRDAI to manage COVID-19 as well as offer versatile coverage.

Why Do We Recommend This?

- Avail AYUSH care

- Family floater policy

- Tax benefits

Recommended Videos

Zuno health insurance awards and accolades.

- FinTech India Innovation Award 2021

- Customer Fest Awards 2021

- Digital Dragon Awards 2022

- Best Customer Experience Team of the Year 2020

- Best BFSI Technology Award - Cloud

Riders Of Zuno Health Insurance

Zuno health insurance plans offer comprehensive coverage. However, to enhance your health insurance experience the health insurer provides add-on covers too.

Health 241

Enjoy two years of coverage for the price of one. If you stay healthy and claim-free in the first year, your second year is on us. This additional rider ensures features such as:

- Get two years of coverage in one.

- Pick it with Gold, Silver, and Platinum variant.

- Covers all the treatment.

New Born Care

This New Born Care addon riders provide the insurance covergae for the newborns from the day they are born. This additional rider ensures features such as:

- Covers delivery expenses.

- Surrogate mothers are also included.

- Waiting period is 48 months.

Documents Required For ZUNO General Insurance Claim

- Correctly signed & filled claim form

- Medical research reports

- Pre-authorization request

- Medical reference slip

- Discharge documents from the hospital

- Operation Theater Reports

- Chemist bills

- Hospital bills

- Others requested by the company

- Copy of Patient Photo ID Card (Hospital Verified)

Health Insurance Premium Calculator

PolicyX.com premium calculator offers premium comparison for some of the best health plans in India. You can input your details and check out some of the most suitable health insurance policies for your specific requirements. This is the easiest, most efficient, spam and gimmick-free way to buy health insurance today.

More Queries?

If you have any more queries regarding

Plans,

Renewals, or Claim Procedures, contact our insurance experts at:

1800-4200-269

now!

Other Health Insurance Companies

Compare mediclaim policies with other top insurers in India.

Know More About Health Insurance Companies

Share your Valuable Feedback

4.4

Rated by 2640 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Simran Saxena

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto is to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Do you have any thoughts you’d like to share?