- Personal Accident Cover

- Worldwide Cover

- Lifelong Renewability

Network hospitals

6000+

Claim settlement ratio

97.64%

Sum insured

Up to 30 Lakh

No. of Plans

1

Solvency Ratio

3

Pan India Presence

110+

Network hospitals

6000+

Claim settlement ratio

97.64%

Sum insured

Up to 30 Lakh

No. of Plans

1

Solvency Ratio

3

Pan India Presence

110+

Health and Term Insurance

Simran is an insurance expert with more than 4 years of experience in the industry. An expert with previous experience in BFSI, Ed-tech, and insurance, she proactively helps her readers stay on par with all the latest Insurance industry developments.

Term & Health Insurance

Sharan Gurve has spent over 9 years in the insurance and finance industries to gather end-to-end knowledge in health and term insurance. His in-house skill development programs and interactive workshops have worked wonders in our B2C domain.

Updated on Apr 08, 2025 4 min read

Janta personal accident policy designed by Liberty Health Insurance is designed specifically to cater to customers settled in rural India. The Janata personal accident policy offers coverage against accidental death along with features such as

The policy covers individuals and dependent children from the age of 5 years to 18 years. In this article, we have mentioned all the essential details and features of the Liberty Janta Personal Accident Policy to help you better understand the policy.

Health Insurance Plans

Choose 1st Plan

Choose 2nd Plan

Health Insurance Plan

To understand Liberty Janta Personal Accident Policy Insurance in detail, take a look at the below table:

Minimum: 18 Years, Child: 5 to 18 Years, Maximum: 75 Years

Accident Health Insurance

NA

30 Days

Lifelong

1 year

*Initial Waiting Period is the time period between the issuance of the policy and the time it starts actively. During this period, a policyholder has to wait to avail of the benefits offered under a health insurance plan.

Read more specifications in the brochure.

| Plan Type | Individual/Family Floater |

| Grace Period | 30 Days |

| Renewability | Lifelong |

| Network Hospitals | 5,000+ |

| Free-Look Period | 15 Days |

With Liberty’s Janta personal accident policy the insurer provides a multitude of benefits and advantages to the customers listed down below

Liberty Health Insurance

Janta Personal Accident Policy offered by Liberty Health Insurance offers coverage majorly for personal accidents along with other physical; damages sustained by the customer in case of an accident.

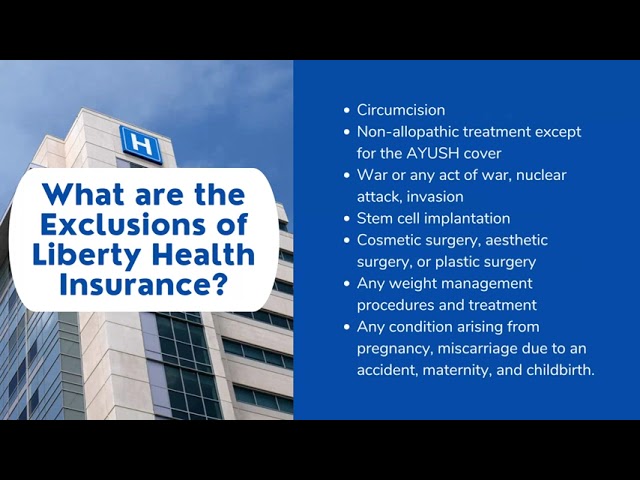

There are a few exclusions under the Janta Personal Accident Policy and customers must read them carefully as written in the policy document in order to make a better decision for their family and self

The policyholder may cancel this policy by giving 15 days written notice and in such an event, the Company shall refund the premium for the unexpired policy period. However, the insurer also has the power to cancel the policy on grounds of misrepresentation, non-disclosure of material facts, and fraud by the Insured Person, by giving 15 days written notice.

To cater to the different medical needs of an individual & their family, Liberty General Insurance offers several Health Plans ranging from senior citizen plans to specialized plans for autistic children, to health insurance for cardiac patients, and many more.Take a look below to Liberty General Insurance plans explore more:

Individual and Family Health Insurance

Secure Health Connect policy designed by Liberty Health Insurance offers comprehensive coverage with a wide range of sums insured from INR 2 lac to 15...

Unique Features

Accident Health Insurance

Janta personal accident policy designed by Liberty Health Insurance is designed specifically to cater to customers settled in rural India. The Janata...

Unique Features

PolicyX.com premium calculator offers premium comparison for some of the best health plans in India. You can input your details and check out some of the most suitable health insurance policies for your specific requirements. This is the easiest, most efficient, spam and gimmick-free way to buy health insurance today.

The eligibility criteria for Janta Personal Accident Policy is as follows Adults - 18 to 75 years Children – 5 to 18 years

The policy tenure for Janta personal accident policy by liberty health insurance is 1 year.

As the name suggests the policy covers personal accidents along with other coverage terms like Loss of limbs Loss of a Limb and an eye Complete loss of eyesight in both eyes Loss of sight of one eye, or total and irrecoverable loss of use of a hand or a foot Permanent Total Disability due to Accident

To cancel a policy the customer may provide a 15-day written notice, after that, the Company shall refund the premium for the unexpired policy period. However, the insurer also has the power to cancel the policy on grounds of misrepresentation, non-disclosure of material facts, and fraud by the Insured Person, by giving 15 days written notice.

At the end of the policy period, the policy shall terminate and can be renewed within the Grace Period of 30 days to maintain continuity of benefits without a break in policy. Coverage is not available during the grace period.

See More Health Insurance Articles

See More Health Insurance Articles

4.4

Rated by 2629 customers

Select Your Rating

Let us know about your experience or any feedback that might help us serve you better in future.

Simran is an insurance expert with more than 4 years of experience in the industry. An expert with previous experience in BFSI, Ed-tech, and insurance, she proactively helps her readers stay on par with all the latest Insurance industry developments.

✖

✖

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Your call has been scheduled with Policyx for health insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata

Do you have any thoughts you’d like to share?