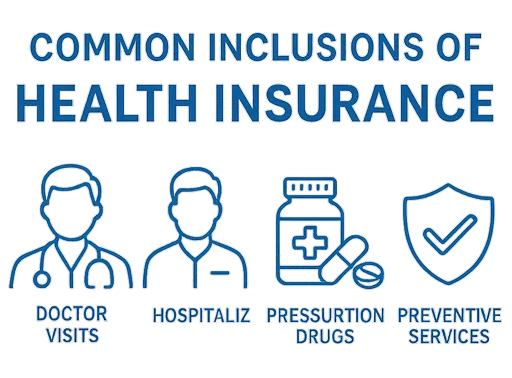

SBI Loan Insurance policy offers comprehensive coverage to t ...Read More

6000+

Network hospitals

98%%

Claim settlement ratio

Up to 2 Cr

Sum insured

1

No. of Plans

1.8

Solvency Ratio

141+

Pan India Presence

11+ Years

IRDAI Approved

5M+

Quotes Generated

100K+

Happy Customers

PolicyX is one of India's leading digital insurance platform

11+ Years

IRDAI Approved

5M+

Quotes Generated

100K+

Happy Customers

PolicyX is one of India's leading digital insurance platform

PolicyX Exclusive Benefits

No Spam

No Gimmicks

Personalised

Insurance Advice

24×7

Claim Assistance

1137-1723616424.webp)

Do you have any thoughts you’d like to share?