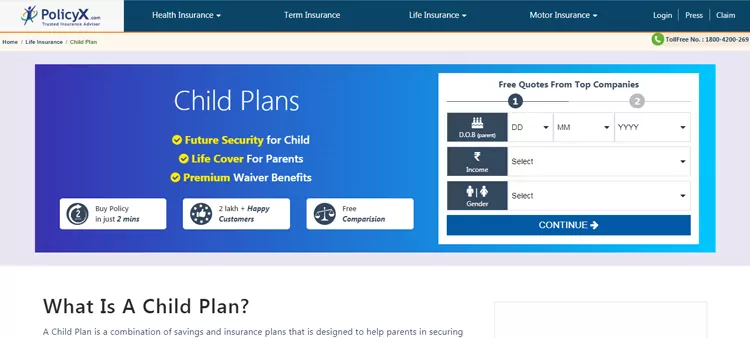

- Secure Your Child's Future

- Grab Income Benefits

- Simple Claim Processing

Buy Policy in just 2 mins

2 lakh + Happy Customers

Free Comparison

Term & Life Insurance

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Insurance & Business

Naval Goel, the founder of PolicyX is a well-recognised name in the Indian insurance and finance industry. His global overview has revolutionised the way insurance is perceived and bought by commoners in India.

Updated on Apr 08, 2025 4 min read

A Child Plan is a combination of savings and insurance plans that is designed to help parents in securing the financial future for their children. The plan allows parents to build a strong financial corpus that can be used to meet the child's future needs like education, marriage, etc.

A Child Education Plan in India is a type of insurance that protects your savings while also ensuring the future of your child. The plan allows you to invest your saving and subsequently use it for your child's education, either in parts or all at once.

Related Articles

Sabse Pehle Life Insurance

April, 2022

When you buy a child plan, you pay premiums for the selected time period. This specific time period becomes your 'policy term' and once the policy term ends, the insurer provides a lump sum amount of your plan in the form of maturity benefit. You can then use this amount to cover your child's education or marriage expenses. If in case any unfortunate event happens with you during the policy term, the entire life cover amount of your plan will be given to your nominee who is responsible for taking care of your child in the future. The insurance provider will waive off all future premium payments for the remaining policy term to ensure that your children's future is always secure.

For better understanding, let's take the help of the example given below.

Mr. Kumar has a 6-year old child, and he wants to invest in a child plan for the higher education of his ward. He decides to invest in a child plan for 14 years with a sum assured of 10 lakhs. He pays the premium every year.

If he dies during the 8th year of the policy, the insurer pays a death benefit to the claimant, and all future premiums are waived off. The plan stays active for the rest of the years. At the time of maturity, the plan will provide a maturity benefit of Rs.10 lakhs to Mr.Kumar's child/claimant.

Parents take care of everything related to the child and want to make sure that their child's every want is looked after with zero compromises. This is where child plans come into the picture. By investing in a child education plan, you will collect enough funds in the times ahead to take care of future expenses related to your child. This is because a child education plan offers comprehensive life insurance coverage along with the maturity benefits to secure a child's future.

So, by buying a child education plan you can rest assured about the fact that even if something unfortunate happens to you and you're no longer around with your family, the needs of your children will be well taken care of.

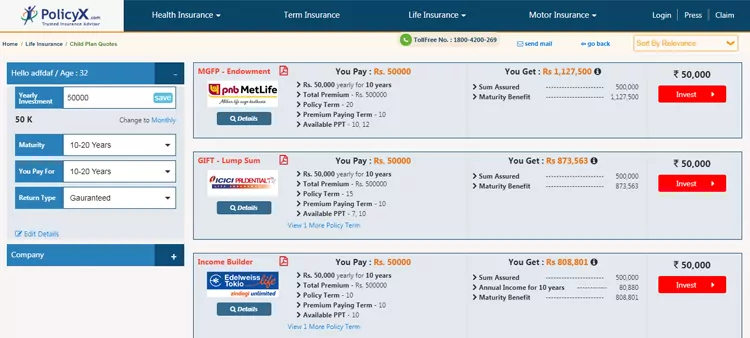

Secure the future of your child with the below-mentioned IRDAI-approved child insurance companies.

To understand the importance of Child Plans, let's dig deeper into their benefits. The list of benefits derived from a child education plan can be quite long. Here we've jotted down some of the basic benefits offered by such plans.

It helps you to build a corpus for your child's education and assists you to save enough for the future. On paying premium timely, the plan will provide a lump sum that will help the child to meet the educational expenses without any financial burden.

These plans offer the convenience of withdrawals during the policy tenure. You can use this money for medical treatment in case your child falls ill.

The death of the parent can cause severe trauma to the child and can keep his/her future hanging. The plan offers a lump sum amount as promised at the time of purchase. Apart from this, if the insured opts for a premium waiver rider, the company will provide a premium waiver in case the parent passes away during the policy tenure.

A few of the child plans provide regular income to children that is equal to 1% of the sum assured.

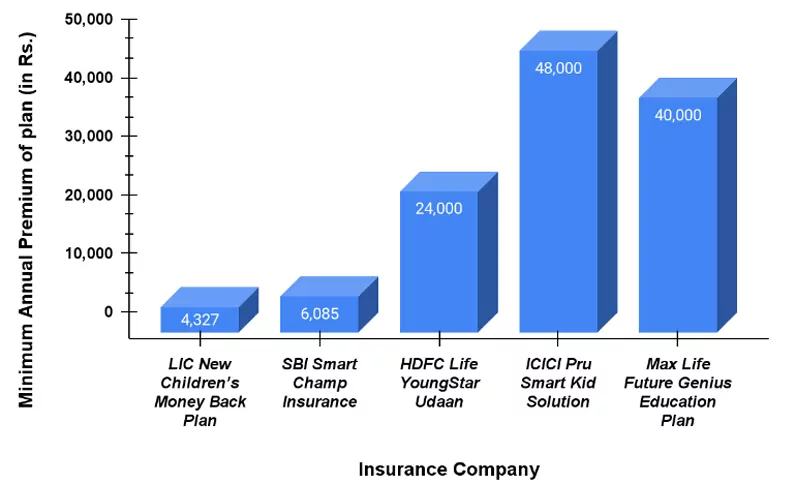

Before buying a child education plan in India, it is crucial to consider these factors such as cost of education, inflation rate, and premium amount. Given the wide range of child education and savings plans available in the insurance market nowadays, it is natural to feel confused about which one you should select for your child. To make things a bit easy for you, our team at PolicyX.com did extensive research on the life insurance providers available in the market and compared them on the basis of their claim settlement ratio and market share. From the results of our evaluation, we've selected the top life insurance companies in the market and listed the best 5 child plans in the table below. Let's learn about them.

| Insurance Company | Plan Name | Minimum Annual Premium | Maximum Sum Assured |

| Life Insurance Corporation of India | LIC New Children's Money Back Plan | Rs. 4,327 | No Limit |

| HDFC Life Insurance | HDFC Life YoungStar Udaan | Rs. 24,000 | Depends on premium chosen, age, policy term and premium payment term. |

| SBI Life Insurance | Smart Champ Insurance | Rs. 6,085 | Rs. 1,00,00,000 |

| ICICI Prudential | Smart Kid Solution | Rs. 48,000 (for one pay option) | 10 times of Single Premium |

| Max Life Insurance | Future Genius Education Plan | Rs. 40,000 | No limit |

*Note: Premiums in this table are calculated for a fixed sum assured of Rs. 1,00,000.

Premium Comparison of Different Child Plans

This is a non-linked, participating, individual, life assurance money back plan that is designed to help customers meet the educational, marriage, and other needs of their growing children through survival benefits. LIC New Children Money Back plan also provides the death benefit of the life assured to his/her beneficiary during the policy term given that the policy is in force.

Eligibility Criteria

| Eligibility Condition | Minimum | Maximum |

| Entry age | 0 years | 12 years |

| Maturity age | - | 25 years |

| Premium payment mode | Monthly, quarterly, Half-yearly, yearly | |

This is a participating endowment and moneyback plan that is ideal for parents who wish to make provision for covering the future financial needs of their child. The plan comes with 3 maturity benefit options along with a classic waiver option that allows customers to match key milestones of their child's aspirations.

Eligibility Criteria

| Eligibility Condition | Minimum | Maximum |

| Entry age | 30 days | 60 years |

| Maturity age | 18 years | 75 years |

| Premium payment mode | Monthly, quarterly, Half-yearly, yearly | |

SBI Life Smart Champ Insurance is an individual, non-linked, participating, life insurance savings product that helps customers in securing their child's future educational needs. In addition to the life cover, this plan provides coverage against life and accidental total permanent disability throughout the policy term.

Eligibility Criteria

| Eligibility Condition | Minimum | Maximum |

| Entry age (of child) | 0 years | 13 years |

| Maturity age (of life assured) | 42 years | 70 years |

| Premium payment mode | Monthly, quarterly, Half-yearly, yearly | |

Smart Kid Solution is a unit-linked insurance plan offered by ICICI Prudential Life Insurance Company with one of its best-seller plans- ICICI Pru Smart Life. This plan is designed to help parent customers in growing their investments and helps them to secure the educational milestones of their children.

Eligibility Criteria

| Eligibility Condition | Minimum | Maximum |

| Entry age | 20 years | 54 years |

| Maturity age | 30 years | 64 years |

| Premium payment mode | Annual, Half-yearly, and Monthly | |

The Future Genius Education Plan is carefully designed by Max Life Insurance company to help customers in managing their child's higher education costs through disciplined savings. The plan comes with a variety of useful benefits including guaranteed money backs, maturity benefit, death benefit, premium waiver benefit, and many more.

Eligibility Criteria

| Eligibility Condition | Minimum | Maximum |

| Entry age (of child) | 21 years | 45 years |

| Maturity age (of life assured) | - | 66 years |

| Premium payment mode | Monthly, quarterly, Half-yearly, yearly | |

There are many child education plans offered by insurance companies. There are a few things that should be considered while choosing such plans. Below-mentioned are the factors that help you to buy the best child education plan to meet the requirement of the child.

Different insurance companies offer different types of Child Plans in India. However, for your reference, we've listed below some of the common child plans available in the insurance market nowadays. Let's take a look.

Single-Premium Child Plan requires a one-time investment, which is also subjected to discounts and other benefits.

Regular-Premium Plan requires you to pay the premium at prefixed intervals. The frequency of premium payments may be monthly, quarterly, half-yearly, or annually (as agreed upon).

In choosing a Child Endowment Plan, you authorise your insurance provider to invest in the instruments of debt. Endowments Plans provide capital appreciation, while steadily adding to the growth of the fund with returns from investments.

ULIP plan is a combination of investment plans and life coverage. They invest the premium paid in equity instruments and debt instruments. Although the plan carries some amount of risk, it yields more returns than endowment plans in the long-term. The policyholder also has the option to switch between funds after a certain waiting period.

Child plans are one of the best investment options, as they are loaded with multiple features like the generation of additional wealth, tax-savings, and more.

Listed below are some of the significant features of child plans:

Waiver of Premium

The child plan has an in-built premium waiver, which is applicable when the parent dies. This feature may vary from insurer to insurer.

Sum Assured

The sum assured for a child plan is usually 10x the gross earnings of the policyholder, which is paid out in the event of the demise of the parent or at maturity.

Partial Withdrawal

Child investment plans offer you the option of withdrawing money at any time during the policy term. When a child is hospitalized due to an illness, a small accident, or a major medical condition, you can partially withdraw the money in such an emergency. The best child plan can be an add-on to one's health insurance.

Choice of Funds

Child plans allow you to choose between different fund options such as equity, debt, money-market, and hybrid. You also have the option of switching between funds after a certain period.

High Returns

The return of child plans goes as high as 12%, which is well above the rate of inflation in the long-term. Therefore, it not only protects your investments from getting eroded (as a result of inflation) but also contributes towards the steady growth of the fund.

Tax Benefits

Child plans are characterised by the triple exempt benefit (EEE exemption), which implies that the investment (premium) is eligible for the tax deduction, the interest earned is exempted from tax, and income generated is also exempted from tax.

Child plan riders are additional benefits that you can add to your existing policy by paying a small premium.

Here is a list for the same:

Child term rider provides death benefits in case of the demise of the child (before a particular age). However, after the child attains maturity, the term plan can be converted to a permanent insurance cover up to five times the original amount without the need for medical exams.

This rider provides an extra sum assured in case of an unfortunate event that leads to the death or disability of the insured.

Critical illness rider offers coverage for a predefined set of critical illnesses.

In case of the demise of the policyholder, the outstanding premium gets waived off, and the beneficiary will get the benefits at maturity.

This rider makes the child eligible to receive 1% of the rider sum assured every month in the following occurrences:

Buying a child plan is not an easy decision. You may have to take into account several factors while deciding the best plan for your child. To help you in making a good decision, we've jotted down a few important points that you should consider while buying a child plan.

Look for Essential Features

Search for all the essential features and rider benefits to secure the financial future of your child.

Claim Settlement Ratio

Always make a point to check the CSR of the insurance provider. With a high claim settlement ratio, there is a significant probability for the company to pass your future claims.

Plan Tenure

Decide the tenure of the policy carefully, ensuring that your child gets all the benefits at the right age. For instance, if your child is below 10 years, (s)he has a lot of time to decide his/her education and career goals. So, the plan tenure should be around 10-15 years.

Fund Allocation

Wisely choose the fund allocation based on your child's age and needs like healthcare, education, wedding, and so on. Many policies offer different fund options with diverse risk factors. You can invest in equity and debt funds to get better returns for your child.

One of the biggest confusion that every customer faces while buying a child plan is deciding the ideal coverage amount for the selected plan. If you're facing this confusion too, read this section thoroughly to understand how much you should invest in a child plan.

In order to decide the right coverage, it is vital to understand the growing expenses of the education industry. The cost of higher education is rising at 10-12% a year. Normally, a four-year engineering course can cost around 7-8 lakhs. In the coming six years, the cost is likely to touch 14 to 25 lakh. By 2027, it would cost around 28 lakhs.

You need adequate investment to counter such expenses. Normally, building a corpus of 1 crore may seem difficult, but it's not impossible to save this amount. You can make it with the help of an SIP of Rs. 9,000 for 18 years in an equity fund at the rate of 15% per year. As the rate of inflation in the education industry is so high, you need compounding to work for you over a longer tenure.

As a parent, your first and foremost duty lies in securing your child's future. To ensure that your child has a bright future and lives the life of his dreams, it is important to start investing in a child plan at an early stage.

The team of PolicyX.com is ready to assist you with the same. We help customers in finding the ideal plan for their child by instantly comparing different child plans, evaluating their features according to the customer's needs, and finding the best plan for them. In addition to this, we have a team of insurance experts who are available 24*7 to address customers' queries.

If you, too, want to save time and need a smooth buying experience, trust no one else than PolicyX.com.

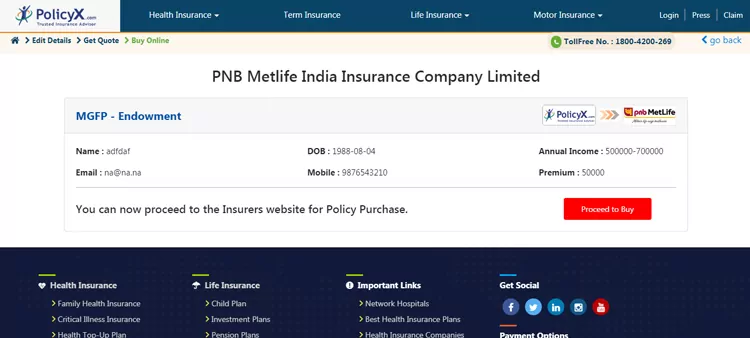

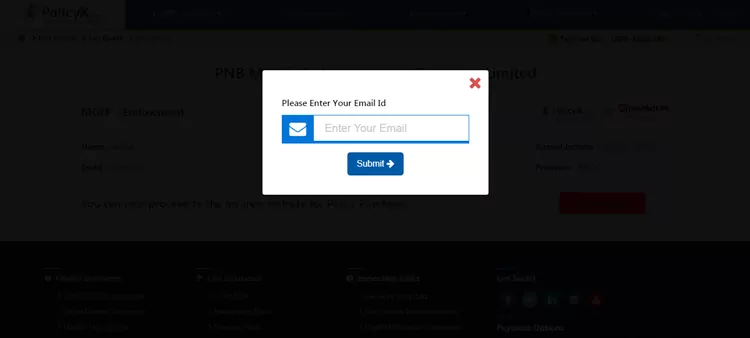

Here is a step-by-step guide that explains how you can buy child plans from PolicyX.com.

After making the payment, you will receive a confirmation along with the policy documents on your registered email address.

Note: In case of any query, feel free to connect on our toll-free number (1800-4200-269). You can also email us at helpdesk@policyx.com.

You must purchase a child insurance policy from a company with a higher claim settlement ratio. This will ensure a smooth and hassle-free claim process and resolution. Almost every insurance company has a similar claim process:

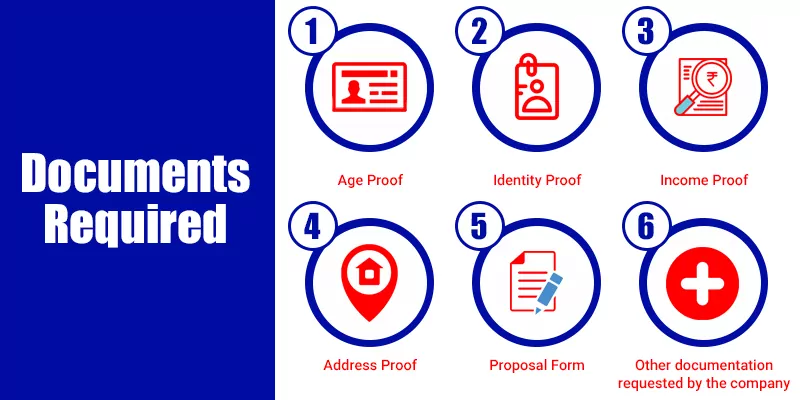

You will need the following documents while filing a claim for a child investment plan:

See More Life Insurance Articles

See More Life Insurance Articles

For any child insurance plan, there is no such strict entry age as it varies from insurer to insurer. However, the minimum age to avail of a child insurance plan is 18 years (for the parent).

Yes. A person gets a loan of 90% against the principal account balance of the Recurring Deposit during the investment tenure. During the Benefit Phase, a person can take a loan at 75% against the remaining FD balance.

There is no such restriction over the sum assured amount. However, the minimum premium amount starts from Rs. 500 per month. It may vary from insurer to insurer.

Yes, it is possible. But you need an appointee, who gets the benefits of the insurance on behalf of the nominee.

This is decided by the insured while investing in a child plan. The frequency is mentioned in the policy document.

To check the policy status, you must first register at the e-portal of the chosen insurance company. After generating your password, you have to log in to your account and check all your policy details.

You can easily withdraw the entire amount after the completion of 5 years (anytime) before the maturity date.

Yes. The money that you withdraw from the child plan during the policy tenure is tax-free. Even the death benefit and maturity benefit are also tax-free.

You should invest in a child plan as soon as possible. Ideally, it should be as soon as your kid is born. However, companies allow you to insure your child within the set guidelines of the entry age that varies from insurer to insurer.

Beneficiary or nominee plays a vital role in a child plan. If the parent dies, all the money and authorities will be handed over to the nominee/beneficiary only.

Amar Patil

Pune

October 9, 2024

I want to thank Shubham Sharma for his exceptional help with my term insurance query. He went above and beyond to assist me. I’m very grateful to Policyx.com and Shubham Sharma.

Sanjeev

Hyderabad

May 20, 2024

SUD Life term plan truly stands out my expectations as I got SUD Life term plan along with additional riders at very affordable premiums.

Sumit

Coimbatore

May 20, 2024

I am impresses with the hassle free and quick claim settlement process of SUD Life. Thanks to PolicyX who guided me to get my claim settled.

Barkha

Delhi

May 20, 2024

Bought SUD Life Family Income Benefit Rider plan to secure the future of my plan financially even in my absence.

Geetanjali

Kolkata

May 20, 2024

I was looking for a term plan to secure the future of my family. So I contacted PolicyX and one of their representatives Mr. Vaibhav helped me choose SUD Life term plan.

Armaan khan

Agra

May 17, 2024

I recently purchased a Pramerica term insurance policy from Policyx.com. The customer service team was very helpful in answering all my queries and guiding me through the application process. I...

Rahul Yadav

Indore

May 17, 2024

PolicyX’s dedicated support made renewing my Bandhan Life Insurance policy easy. I’m absolutely delighted with the service offered by PolicyX Insurance Advisor.

Priyanshu Sharma

Delhi

May 17, 2024

I bought a Bandhan Life Insurance through PolicyX, and I must say the level of communication and assistance I have received has been truly impressive.

✖

✖

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Your call has been scheduled with Policyx for term insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata