- Affordable premiums

- Tax benefits

- Flexible policy term

Get the Right Insurance Plan for You

Get upto 15% Online Discount*

Insurance Experts

No Gimmicks

- No Spam

- No Mis-Selling

- No Pushy Sales

Buy Policy in just 2 mins

2 lakh + Happy Customers

Free Comparison

Get the Right Insurance Plan for You

Get upto 15% Online Discount*

Term & Life Insurance

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Health Insurance

Raj Kumar has more than a decade of experience in driving product knowledge and sales in the health insurance sector. His data-focused approach towards business planning, manpower management, and strategic decision-making has elevated insurance awareness within and beyond our organisation.

Updated on Apr 08, 2025 4 min read

Life Insurance Corporation of India (LIC) was set up on 1st September 1956, with the aim of expanding the concept and importance of Life Insurance all over India. From then to now, LIC has crossed many milestones and has set unprecedented performance records in the Life Insurance business. In earlier days, the premium amount was paid through LIC agents or visiting the nearest branch office.

Hence, to reduce the effort for the policyholders, LIC India has started this online payment services for paying the premium amount. Stilt, most policyholders are not aware of the LIC Online Payment, and they still depend on the LIC agents. To make the process more faster and increase independency, LIC started LIC online payment services where one can pay premiums easily in a few minutes, check the policy status and whether the policyholder is a registered user or non-registered user. Additionally, one can pay for more than one policy from a single account (but this is not recommended by LIC). Read the whole article to make easy and secure Online Premium Payment for the policies offered by LIC.

| LIC’s Website | Net banking | Credit card / Debit card | BHIM UPI | Online Wallets |

| Authorized Banks | Axis Bank | Corporation Bank | — | — |

| Franchisees | AP (Andhra Pradesh) Online | MP (Madhya Pradesh) Online | Suvidha Infoserve | Easy Bill Pay |

| Authorized Merchants | Premium Point Agents | Life-Plus (SBA) | Retired LIC Employees’ Collection | — |

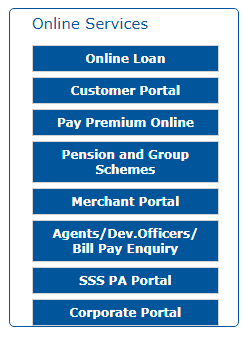

Step 1 : Go to the official website of LIC (www[dot]licindia[dot]in), now go to the ‘Online Services’ section located on the left side of the homepage. Click on the option of ’Pay Premium Online’.

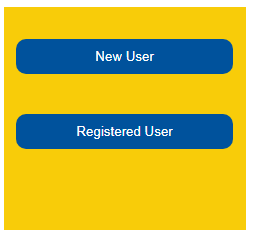

Step 2 : After clicking the option it will directly open a page in front of you containing two options, namely ’Pay Direct (Without login)’ and ’Through Customer Portal’.

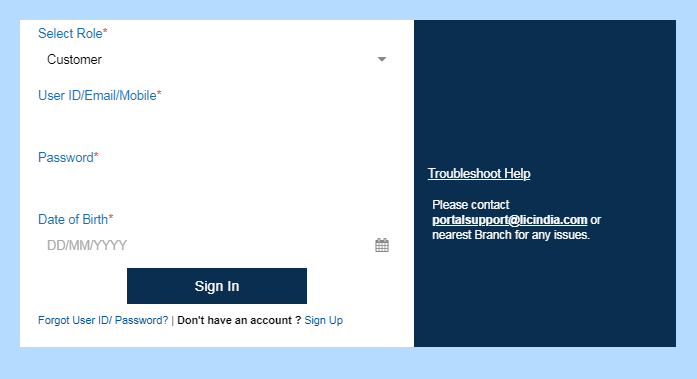

Step 3 : By clicking the ‘’Through Customer Portal’ option, a different page appears with LIC ‘Login ID’ and ‘Password’ fields.

Step 4 : You need to fill the ‘Username and Password’ details in it and click on ‘Submit’ option.

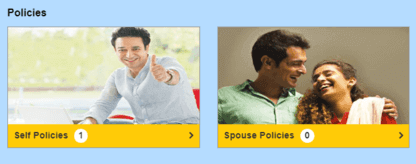

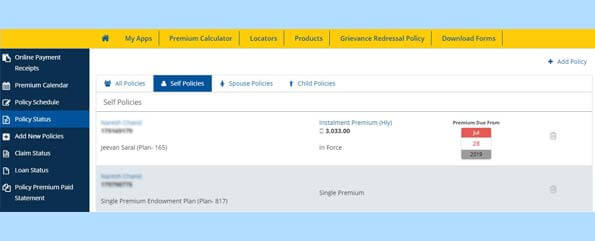

Step 5 : Once login all you need to click on ‘Self Policies’ option to extract the policy details.

Step 6 : Once the ‘Self Policies’ page is opened, click on the ‘Policy Number’ for further information, a page with complete details appears in front of you.

Step 7 : After viewing the policy details , you will be able to see an option of ’Check & Pay’ to make an online payment.

Step 8 : Select the policy for which you want to pay and click on the ’Check & Pay’ button. It will take you to the payment gateway where you need to make the payment.

Step 9 : Once you have clicked the ’Check & Pay’ button, the next screen will show you the option to pay through different modes of payment inclusive of Net Banking, Credit/Debit Card, Wallet, etc. Click on the option of your choice and proceed to complete the transaction of LIC premium payment.

Step 10 : After selecting the mode of payment, a list of banks will display on the screen. The policyholder needs to pay the convenience fees and service tax for processing the LIC Premium payment. Select the bank and click on the ‘submit’ button.

Step 11 : Fill all the details and click on the ‘Make Payment’ button, your payment will be processed. You will receive a payment receipt in th registered e-mail ID and yes! It’s done.

Step 1 : Go to the LIC website (www[dot]licindia[dot]in), The home page of LIC will display on the screen. Look for the ‘Online Services’ section provided on the left side of the web page.

Step 2 :Click on the option ’Pay Premium Online’ that will open a page containing two options: ’Pay Premium through e-Services’ and ’LIC Pay Direct’.

Step 3 : Since you are a non-registered user, you need to select ’LIC Pay Direct’ option for LIC online premium payment.

Step 4 : Now, you will be redirected to a new page. Fill all the information required like the Policy Number, Date of Birth, Mobile Number, e-mail ID, etc. in the page displayed.

Step 5 : And then proceed by clicking the ‘Submit’ option.

Step 6 : Once you enter these details you will be redirected to the payment page, where you can pay the premium amount as per your convenience.

Step 7 : Hence, after the completion of successful payment, a LIC online premium payment receipt with a digital signature on it shall be mailed to the provided e-mail ID. Keep the payment receipt with you as an evidence for your payment.

The policyholder can also use his/her credit/debit card to make the online payment for LIC premiums apart from net banking. The online LIC payment of premiums using credit/debit cards is processed via IDBI Gateway. The credit/debit card payments shall be initiated in 3 simple steps:

| Anmol Jeevan-II (Table No. 822) | Amulya Jeevan-II (Table No. 823) |

| Future Plus (Table No. 172) | Bima Plus (Table No. 140) |

| Jeevan Plus (Table No. 173) | Market Plus (Table No. 181) |

| Money Plus (Table No. 180) | Fortune Plus (Table No. 187) |

| Profit Plus (Table No. 188) | Market Plus (Table No. 191) |

| Jeevan Saathi (Table No. 199) | Money Plus (Table No. 193) |

| Health Protection plus (Table No. 902) | Health Plus (Table No. 901) |

Today, everyone is busy, that is why it is necessary to offer online facilities to reduce the time and labour of society.

Like most of the other insurance companies, LIC has also made it easier for customers to pay premiums online and check the status of the policy anytime from anywhere. The update feature of the same also makes it more reliable.

LIC comes out with a large client base to assure that the customers of LIC need not wait in long queues to make the payment or to make renewals. LIC offers several online premium payment options. Now people can go online to make premium payments and can also deposit premium in one of the authorized centres.

Only 2 banks are authorized by LIC for collection of premium payments:

Most of the customers find it difficult to pay the premiums as they are not very much familiar with the online services or internet, they prefer to make payments by way of offices rather than using online website. Those people will be happy to get to know that LIC also offers many options for premium payment through various private companies and government service providers.

In total, 4 service providers are working along with LIC to assure services for offline premium payment to customers. Let’s have a look at the following:

Nevertheless, there are few things that one must look after while paying LIC premium payments through the above modes:

For convenience at a certain level, LIC provides this option as well, agents such as Senior Business Associates (SBA) development officers and retired employees of LIC are assigned as payment collection agents. Important things to keep in mind when making payment for premiums through the authorized agents:

| Anmol Jeevan-1 (Table No. 164) | Anmol Jeevan (Table No. 153) | Amulya Jeevan (Table No. 177) | Amulya Jeevan (Table No. 190) |

Paytm, one of the popular mobile payments apps has also introduced LIC premium payment option in its application so as to support customers and policyholders of LIC to make their payments easy without visiting the website and hassle of logging in the account just within a few clicks using net banking facility.

*Without any worries, you can trust and choose LIC online payment services and paytm for your payment of monthly premiums at one go!

The LIC Customer Care number is 022-6827-6827

Availability as follows:

Monday to Friday: 08.00 a.m.-08.00 p.m.

Saturday: 10.00 a.m.-06.00 p.m.

Jeevan Akshay- VII (Table No. 857) is a single premium, non-linked, and non-participating immediate annuity plan. It pays annuity or pension to the po...

Unique Features

LIC Nivesh Plus is a unit-linked, non-participating, and single-premium individual life insurance plan. It offers insurance cum investment benefits th...

Unique Features

LIC Bima Shree Policy is a traditional, non-linked, and with-profit money-back life insurance policy that features guaranteed additions to provide sec...

Unique Features

LIC SIIP is a unit-linked non-participating individual life insurance plan. The plan comes out as an opportunity to monetize the investment options of...

Unique Features

LIC Navjeevan is a newly launched plan by the Life Insurance Corporation of India. It is a non-linked with profit endowment assurance plan. It is a co...

Unique Features

LIC has been very dynamic in introducing plans according to different individuals' demands. The LIC Komal Jeevan Plan is exclusively fabricated for ch...

Unique Features

LIC Micro Bachat Plan (Table No. 951) is a traditional, non-linked, participating micro-insurance plan that offers dual benefits of protection as well...

Unique Features

LIC Jeevan Saathi is basically an endowment assurance policy that is there to ensure the lives of husband and wife. It offers the required financial p...

Unique Features

Life Insurance Corporation (LIC) is an Indian insurance company owned by the Government of India. It was founded on 1st September 1956 and is headquar...

Unique Features

(A Perfect Gift For Your Beloved Daughter) LIC Kanyadan policy is the perfect financial coverage for your daughter with a very low premium. Unlike oth...

Unique Features

Pradhan Mantri Vaya Vandana Yojana is a single premium payment pension plan. This pension plan offers an option to either choose the amount of pension...

Unique Features

LIC Jeevan Saral is an Endowment Assurance plan under which the proposer has simply to choose the amount and mode of premium payment. The plan comes o...

Unique Features

It is a traditional endowment with death and maturity benefits to the policyholder. Even a bonus facility is given along. In this plan, the premium is...

Unique Features

LIC New Endowment Plan-one of the best policy by LIC India. The LIC New Endowment plan (Plan No: 914) is a must-avail plan considering the many benefi...

Unique Features

For the financial security of children and families, the LIC Jeevan Lakshya Plan (Plan No: 933) is the most suitable one. It is a collection of saving...

Unique Features

LIC Jeevan Rakshak Plan (Table No. 827) is a participating non-linked plan that provides a combination of insurance and savings. As the name suggests,...

Unique Features

LIC New Jeevan Anand is a participating non-linked plan providing a combination of both protection and savings. The plan offers financial protection a...

Unique Features

LIC Jeevan Umang (Plan No: 945) is a conventional, with-profit, non-linked endowment plan with complete life insurance coverage. The policy provides t...

Unique Features

LIC’s Aadhaar Shila Plan (Plan No: 944) is a non-linked insurance plan, with profits and a regular premium-paying endowment plan. This plan is a...

Unique Features

LIC's Aadhaar Stambh Plan (Plan No: 943, UIN: 512N310V01) is a non-linked insurance plan, with profits and a regular premium-paying endowment plan. It...

Unique Features

Of the many efficient plans of LIC, the Jeevan Shikhar Plan stands out in terms of benefits and simplicity of terms. The endowment plan was initially ...

Unique Features

LIC Jeevan Akshay VI Plan is an immediate annuity pure pension plan for senior citizens provided by one of the top ranked insurance companies in India...

Unique Features

The LIC New Money Back Plan 20 Years (Plan No: 920)was floated on January 6, 2014 to cater to the financial needs of the business and the salaried cla...

Unique Features

LIC Jeevan Shagun is a non-linked, participating, savings with protection single premium Money-Back plan. The policy provides high life cover in the e...

Unique Features

When it comes to offering a complete insurance suite of the most comprehensive financial security in terms of health and life, you are in safe hands w...

Unique Features

LIC launched the Bima Diamond Plan (table No. 841) on September 19, 2016. This is a non-linked plan, i.e. it doesn't depend on the share market. It is...

Unique Features

Ever come across a large pile of banknotes? You know, by winning the lottery or hitting the jackpot at your favorite casino? Your first instinct must ...

Unique Features

The future of the world depends on the strength of the children today. But if they are not prepared for that purpose, the dream will be unattainable. ...

Unique Features

LIC's Jeevan Tarun is basically a participating non-linked limited premium plan that offers a great combination of protection along with savings for y...

Unique Features

This plan has double roles to play. Firstly, this plan is applicable for safeguarding a family after the untimely death of the policyholder. Secondly,...

Unique Features

LIC Jeevan Labh (Plan No: 936) is a limited premium paying, non-linked (Not dependent on equity-based funds and money/share market) with-profit endowm...

Unique Features

Yes, you can pay the premiums of your LIC policy online through Debit card, Credit Card, Net banking or UPI.

You can pay LIC premiums online through following sources: Offline Cash Bill Pay (In LIC offices). Payment by Cheque. National Automated Clearing House (NACH) Pay.

Compare and buy the most suitable Life Insurance Plan from the below-mentioned IRDAI-approved Life Insurance companies.

4.6

Rated by 854 customers

Select Your Rating

Let us know about your experience or any feedback that might help us serve you better in future.

Himanshu is a seasoned content writer specializing in keeping readers engaged with the insurance industry, term and life insurance developments, etc. With an experience of 2 years in insurance and HR tech, Himanshu simplifies the insurance information and it is completely visible in his content pieces. He believes in making the content understandable to any common man.

You May Also Know About:

✖

✖

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Your call has been scheduled with Policyx for term insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata

Do you have any thoughts you’d like to share?