- Calculate Axis Max Life policy premiums

- How Axis Max Life calculator works

- How to use Axis Max Life calculator

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Sharan Gurve has spent over 9 years in the insurance and finance industries to gather end-to-end knowledge in health and term insurance. His in-house skill development programs and interactive workshops have worked wonders in our B2C domain.

Updated on Apr 08, 2025 4 min read

Let’s understand the working of the Axis Max Life Insurance Calculator with a simple example.

Mr Raghav who is a 34-year-old non-smoker is working in an MNC as Assistant Sales Officer. He wants to buy life insurance with a sum assured of Rs 2 crore to secure the future of his family members even in his absence. He decides to pay the premium till he turns 75. By entering the details in the Axis Max Life Insurance Calculator you will get the premium amount.

| Frequency | Total Premium Including Taxes |

| Monthly | Rs 2,818 |

| Quarterly | Rs 8,356 |

| Half-yearly | Rs 16,424 |

| Yearly | Rs 32,014 |

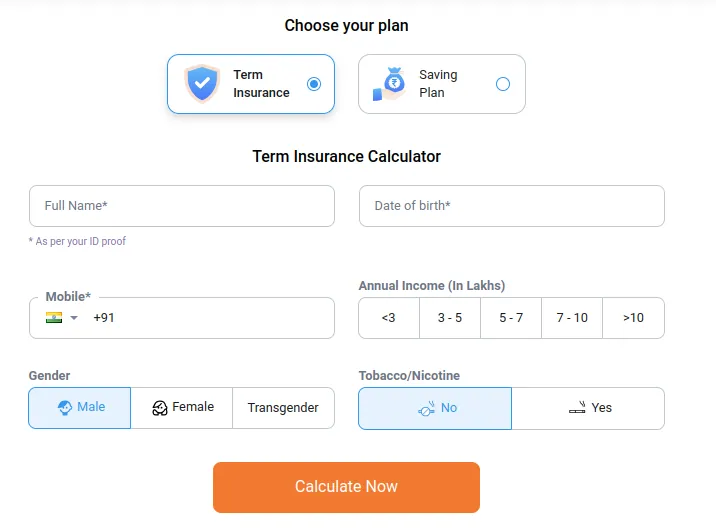

Using the Axis Max Life Insurance Calculator is simple and hassle-free. To use the Axis Max Life Insurance Calculator you have to follow the below-mentioned steps:

The basic details you have to enter in the Axis Max Life Insurance Calculator to calculate the premium include:

The premiums calculated by Axis Max Life Insurance Premium Calculator are inclusive of the 18% GST amount.

Using the Axis Max Life Insurance Calculator has numerous advantages.

Axis Max Life Insurance Premium Calculator helps you make a quick decision by comparing different plans and choosing the one that is suitable for you.

Axis Max Life Insurance Calculator is a free tool available on the official website of Axis Max Life. Anyone can use it easily without any prior knowledge or experience.

You can easily calculate your life insurance premium using the Axis Max Life Insurance Calculator and buy the policy online and get attractive discounts thereby eliminating charges of intermediaries and brokers.

You can get information about the factors that affect your premium such as smoking habits, alcohol consumption, health condition, etc. It helps you make conscious decisions for the future.

Axis Max Life Insurance helps you calculate your life insurance premium. Knowing your insurance premium in advance helps you manage your finances and budget in advance.

The age of the policyholder affects their life insurance premium. A higher age attracts more premium as compared to a lower age as the risk associated increases with an increase in age.

Policyholder’s gender affects their life insurance premium as the life expectancy of females is greater than males. So females are charged a lower premium as compared to males.

The medical history of the policyholder affects their premium. If an individual has a pre-existing illness or disease then they might be charged a higher premium by Axis Max Life.

The health history of the policyholder’s family is also important as certain diseases are hereditary. They pass on from parents to their children which is important for insurer to know.

You will be charged a high life insurance premium if you have smoking habits as the chances of heart disease and cancer are greater.

Axis Max Life Insurance Premium Calculator is a free online tool available for everyone to compare different Axis Max Life insurance plans and choose the suitable one. Using this tool is easy and hassle-free as it requires no prior knowledge. You have to just input your basic information such as age, gender, health history, annual income, etc and it will calculate your life insurance premium within a few seconds.

Compare and buy the most suitable Life Insurance Plan from the below-mentioned IRDAI-approved Life Insurance companies.

4.6

Rated by 854 customers

Select Your Rating

Let us know about your experience or any feedback that might help us serve you better in future.

Himanshu is a seasoned content writer specializing in keeping readers engaged with the insurance industry, term and life insurance developments, etc. With an experience of 2 years in insurance and HR tech, Himanshu simplifies the insurance information and it is completely visible in his content pieces. He believes in making the content understandable to any common man.

Do you have any thoughts you’d like to share?