- PNB Metlife premium receipt details

- Importance for policyholders

- Download process

Buy Policy in just 2 mins

2 lakh + Happy Customers

Free Comparison

Term & Life Insurance

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Term & Health Insurance

Sharan Gurve has spent over 9 years in the insurance and finance industries to gather end-to-end knowledge in health and term insurance. His in-house skill development programs and interactive workshops have worked wonders in our B2C domain.

Updated on Apr 08, 2025 4 min read

PNB Metlife’s online payment receipt is a document provided by PNB Metlife to their policyholders that serves as their insurance premium payment proof. They may provide this document either as a soft copy or a hard copy. This document is important for policyholders as it serves as payment proof, helps to claim applicable tax benefits, and is required at the time of claim submission. PNB Metlife premium receipt contains important information including the policyholder’s details, policy details, the premium amount paid, mode of payment, tax benefits, customer support details of PNB Metlife, and certain terms and conditions. This article highlights the importance of premium receipt, the information it contains, and how you can obtain the same.

You can download your PNB Metlife Premium Receipt either by visiting their website or one of their nearest branch offices.

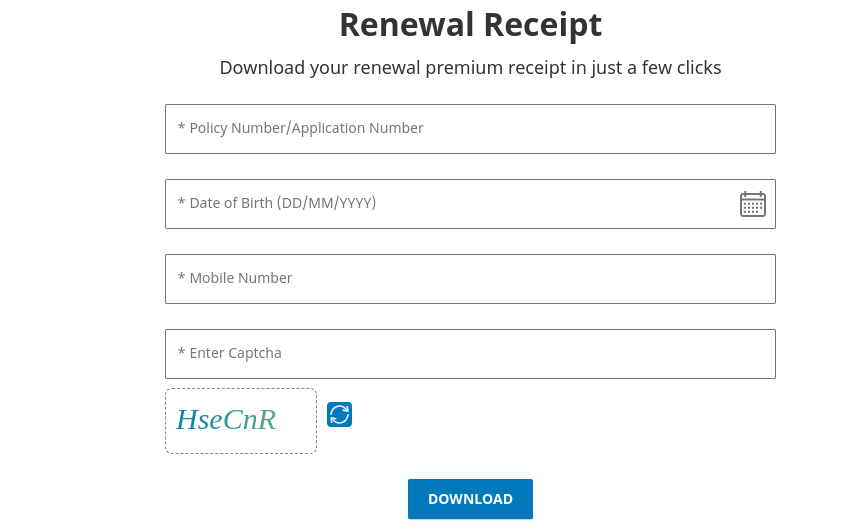

Visit the official website of PNB Metlife.

Click on ‘Our Services’ and choose ‘Manage your insurance policy’.

Click on the ‘Download Renewal Receipt’.

Enter your policy number/ application number along with your date of birth, mobile number, and the captcha code.

Click on ‘Download’ to get your PNB Metlife Premium Receipt.

You can visit one of the nearest branch offices of PNB Metlife. Provide them with your policy number or registered contact number. One of their agents will provide you with the payment receipt either as a soft copy or a hard copy.

PNB Metlife premium receipt contains the following information:

PNB Metlife Online Payment Receipt is an important document for policyholders for various reasons including:

You can contact PNB Metlife using the below-mentioned channels.

By visiting their nearest branch

You can contact PNB Metlife by visiting their nearest branch office. To locate your nearest branch you can use their Branch Locator.

You can mail them to the following email address

For Queries: indiaservice@pnbmetlife.co.in

For Grievance Redressal: gro@pnbmetlife.co.in

PNB Metlife customer service

1800-425-6969 (Our Toll-Free Number In India) +91-80-26502244 (For International Callers) (Monday – Saturday | 10 A.M. – 7 P.M.)

Hope you have understood the PNB Metlife Premium Receipt, its importance, the whole procedure to obtain it, and what information it contains. You must have this payment receipt irrespective of its form (soft copy or hard copy). It offers numerous benefits to the policyholders including proof of payment, claiming tax benefits, and required by the nominee while filing the claim. If you have bought the PNB Metlife term plan from PoliyX.com and facing any difficulties in getting your payment receipt then one of our representatives will help you with the same.

PNB Metlife Premium Receipt is an online document that indicates that the insurance premium has been paid by the policyholders.

PNB Metlife Premium Receipt contains the policyholder’s details, policy details, amount and mode of premium, tax benefits applicable, etc.

You can download the PNB Metlife payment receipt either by visiting their website or one of their nearest branch offices.

You can pay PNB Metlife premium online using UPI, net banking, debit card, credit card, etc.

PNB Metlife receipt acts as proof of payment, helps claim tax benefits, and is required during claim processing.

Compare and buy the most suitable Life Insurance Plan from the below-mentioned IRDAI-approved Life Insurance companies.

4.6

Rated by 855 customers

Select Your Rating

Let us know about your experience or any feedback that might help us serve you better in future.

Himanshu is a seasoned content writer specializing in keeping readers engaged with the insurance industry, term and life insurance developments, etc. With an experience of 2 years in insurance and HR tech, Himanshu simplifies the insurance information and it is completely visible in his content pieces. He believes in making the content understandable to any common man.

You May Also Know About:

✖

✖

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Your call has been scheduled with Policyx for term insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata

Do you have any thoughts you’d like to share?