PolicyX.com

Term Insurance Price Index

Analysis and insights from pricing of term insurance

from leading insurance companies in India.

Analysis and insights from pricing of term insurance

from leading insurance companies in India.

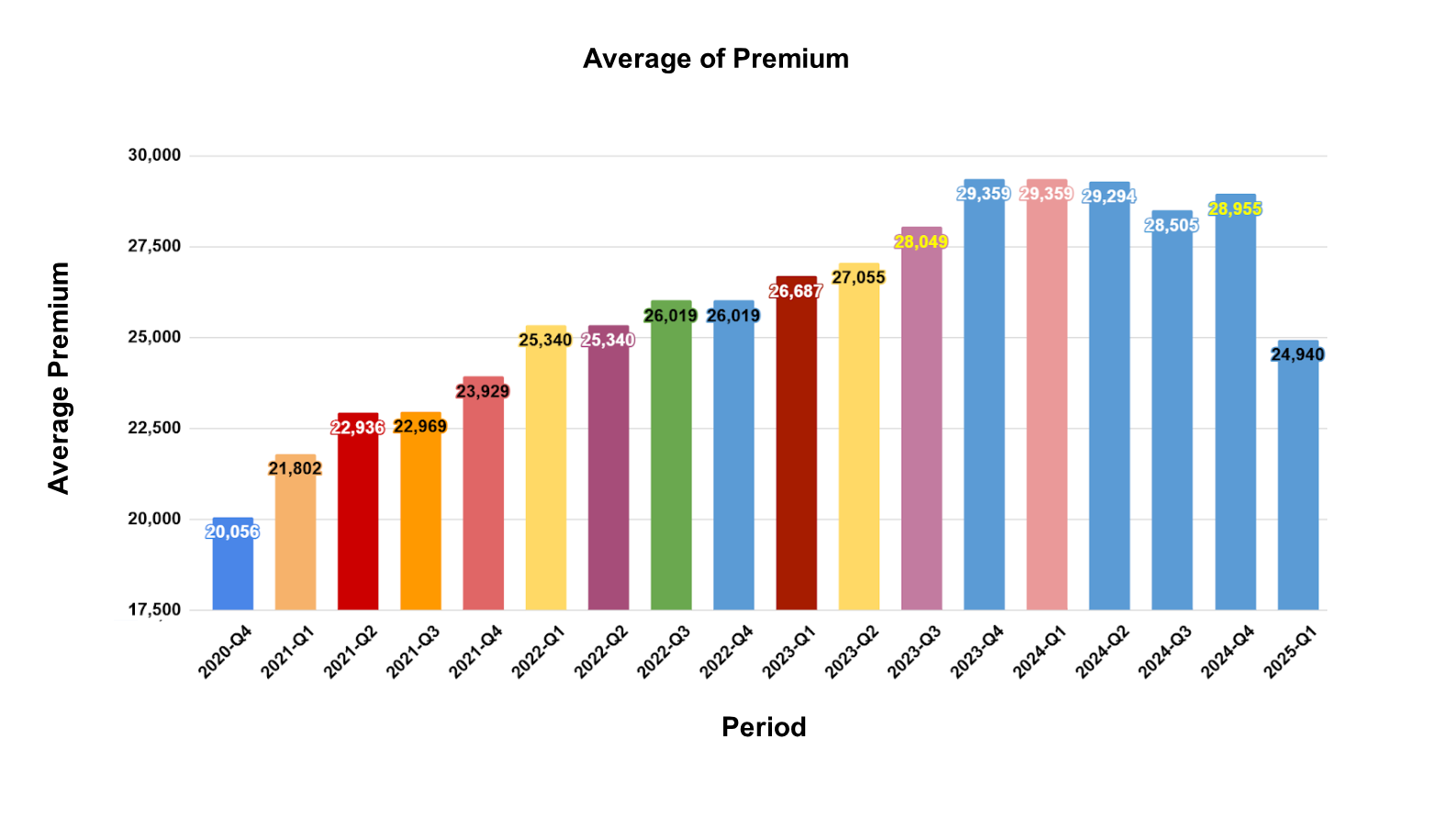

The latest term insurance price index reveals mixed trends for consumers, indicating a dynamic shift in the market. The premiums decreased by 13.87% in Q1 2025 as compared to the previous quarter, Q4 2024.

Overall, the index displays that the latest premium has increased by a significant 24.35% since the PolicyX.com insurance price index was launched in Q4 of 2020. This increase is a result of an increase in prices by most of the life insurance companies in the country due to the increasing death claims.

The current term insurance price index shows various trends for consumers: premiums decreased by 13.87% in Q1 2025 as compared to the previous quarter, though it’s not applicable for all insurers. Some insurers increased their premiums, others decreased, and many insurers kept their premium rates the same without any changes.

Key Findings from Q1 2025:

Premium Increase for Females:

Premium Increase for Males:

A Noteworthy Trend: The slight increase in premiums by the insurance industry highlights their commitment to offering cost-effective financial security solutions. These varied premium trends, especially for females and smokers, display the insurance sector’s aim to make term insurance more affordable and easily accessible to larger sections of consumers.

| Age | Gender | 1 Cr | 50 Lac | Grand Total | ||

| Non-Smoker | Smoker | Non-Smoker | Smoker | |||

| 25 | Female | 9,524 | 16,232 | 6,526 | 11,353 | 10,909 |

| Male | 10,810 | 18,867 | 7,563 | 12,683 | 12,481 | |

| 35 | Female | 14,240 | 24,758 | 9,658 | 16,293 | 16,237 |

| Male | 17,544 | 29,244 | 12,090 | 19,899 | 19,694 | |

| 45 | Female | 24,801 | 43,603 | 17,197 | 27,362 | 28,241 |

| Male | 32,974 | 52,957 | 19,758 | 35,984 | 35,418 | |

| 55 | Female | 49,807 | 83,177 | 29,490 | 51,058 | 53,383 |

| Male | 57,820 | 98,939 | 35,094 | 60,400 | 63,063 | |

| Grand Total | 27,190 | 45,972 | 17,172 | 29,379 | 29,928 | |

Source: Average prices have been determined by considering the leading 5 term insurance companies in India. These prices are for illustration purposes & the actual price may vary depending on the insurer, age, gender, health condition, sum assured, and coverage type.

Overall, the term insurance cost has decreased by 13.87% in Q1 2025 as compared to Q4 2024.

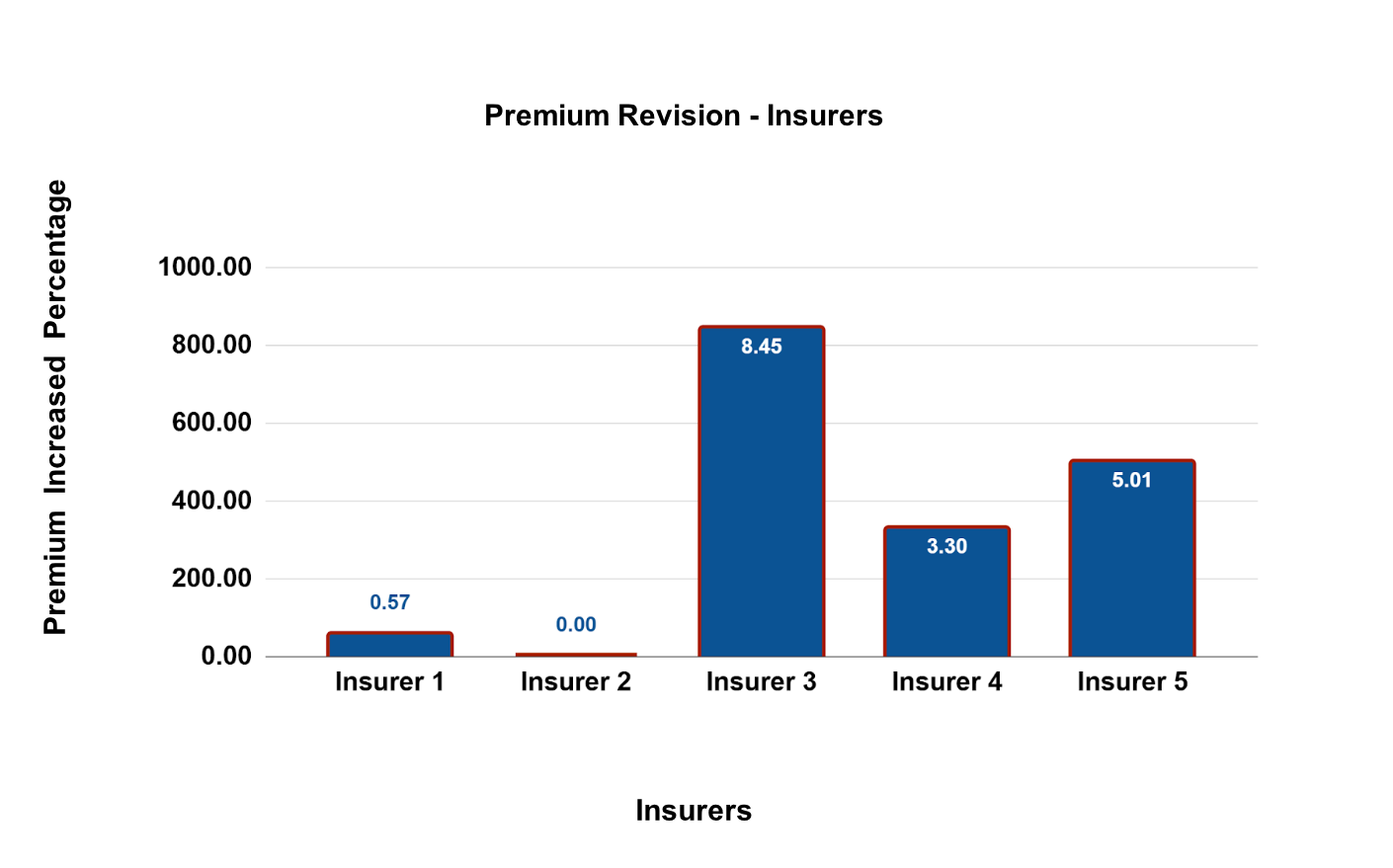

One insurance company has increased the premiums by only 0.57%, while the premiums for one insurance company remain stagnant, and three insurance companies have witnessed a premium increase by 8.45%, 3.30%, and 5.01% respectively.

Age is a vital deciding factor impacting your term insurance premiums. The younger you are, the lower your premiums are. On delaying the purchase of a term insurance plan by 10 years, you might have to pay an increased premium of:

When it comes to purchasing a term plan, the right time is now! The earlier you buy a term plan, the lower your premiums are. Being young represents less risk for the insurance company, thus making your premiums comparatively lower at an early age.

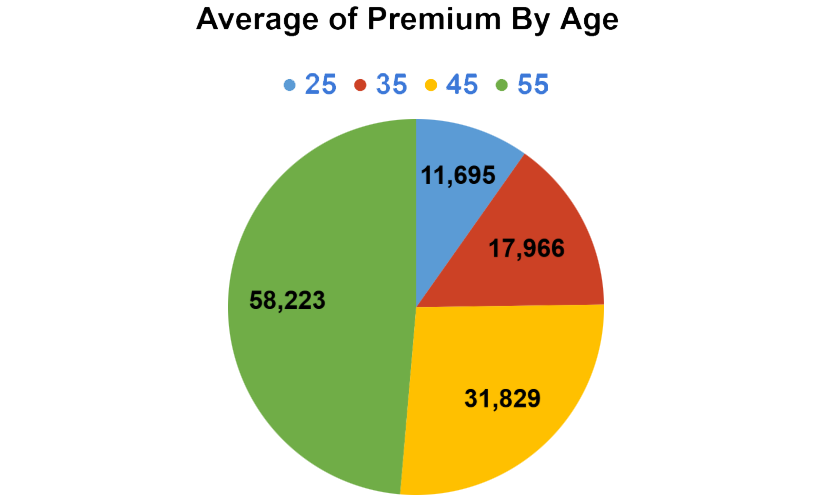

| Age | AVERAGE of 2025-Q1 |

| 25 | 11,695 |

| 35 | 17,966 |

| 45 | 31,829 |

| 55 | 58,223 |

If you buy a term plan at the age of 35, the premiums would be 53.62% higher as compared to premiums at 25 years of age. The premium further increases by 77.17% if you buy a term plan at 45 years. Moreover, the premiums further increase by 82.92% if you delay the purchase of the term plan to 55 years

| Age Brackets | % Change in premium prices |

| 25-35 | 53.62% |

| 35-45 | 77.17% |

| 45-55 | 82.92% |

In the first quarter of 2025, the term insurance price index highlights a significant gap in premiums based on gender. Males have to pay a 20.12% higher premium compared to females, showcasing the affordability advantage for women in the term insurance market.

In most cases, males buy a term insurance plan to safeguard their family’s financial future. To promote awareness of term plans among females, insurance companies offer lower premium prices and special discounts to females.

If you require the best term plan, you need the help of a term insurance premium calculator. Use PolicyX.com's term insurance calculator to look at the average premium for your age and gender.

Calculate NowThe current trends of the term insurance price index display premium differences due to the smoking habits of policyholders.

Non-Smoker Vs. Smoker Premiums: As per recent data, non-smokers have to pay lower premiums compared to smokers due to their decreased risk profile.

For example, smoking females: pay around 70.55% higher premiums for a 1 Crore term plan when compared to a non-smoking female. Similarly, for males, the premium differential is approximately 67.86% higher for smokers.

To update the PolicyX Price Index, we have considered the average premium prices of 5 best term insurance companies in India, in terms of their latest earned Gross Written Premium (GWP). The companies included in our data analysis are Tata AIA Life, HDFC Life, ICICI Prudential, Axis Max Life, and Bajaj Allianz Life.

The prices given are a representation of the yearly premium for every sample policyholder in terms of age, gender, and smoking status in Q1 2025 (April - June 2025). In addition, the analyses also factor in the sum assured and the policy type for a comprehensive evaluation. It is important to note that the insurer's rate may vary depending on age, gender, health profile, sum assured & coverage type.

Got a press query? Contact our press team, they'll be happy to help with any questions you may have regarding the latest price index.

For feedback and suggestion: helpdesk@policyx.com

Contact Our Team