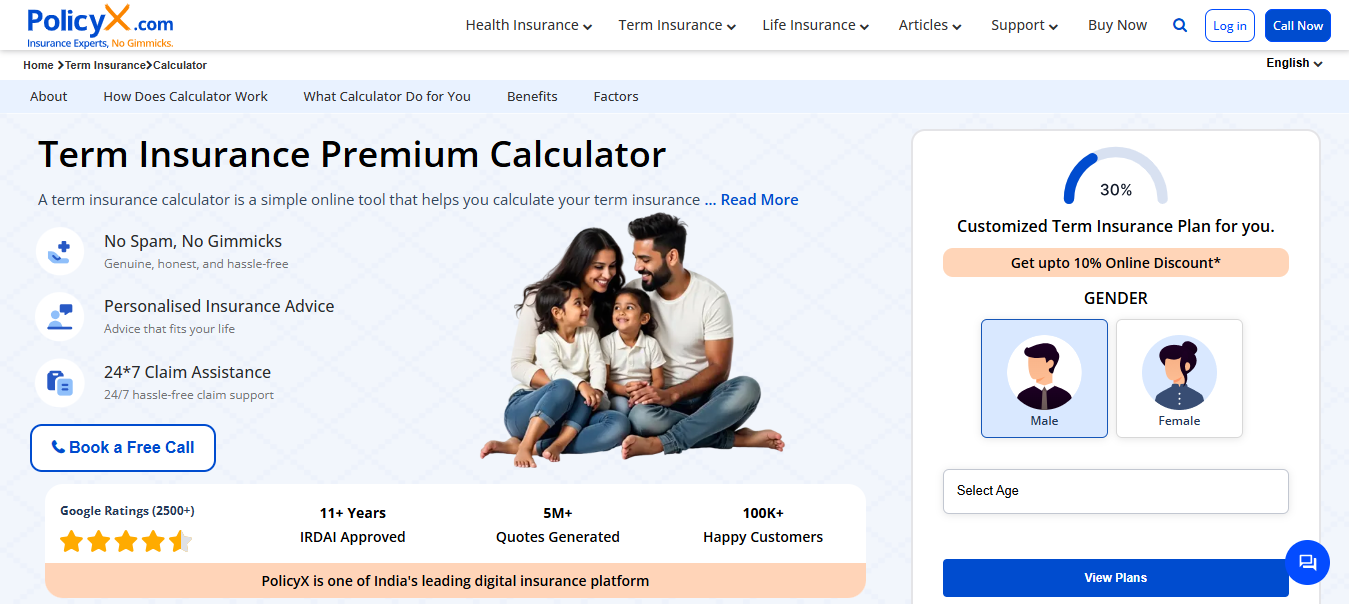

11+ Years

IRDAI Approved

5M+

Quotes Generated

100K+

Happy Customers

PolicyX is one of India's leading digital insurance platform

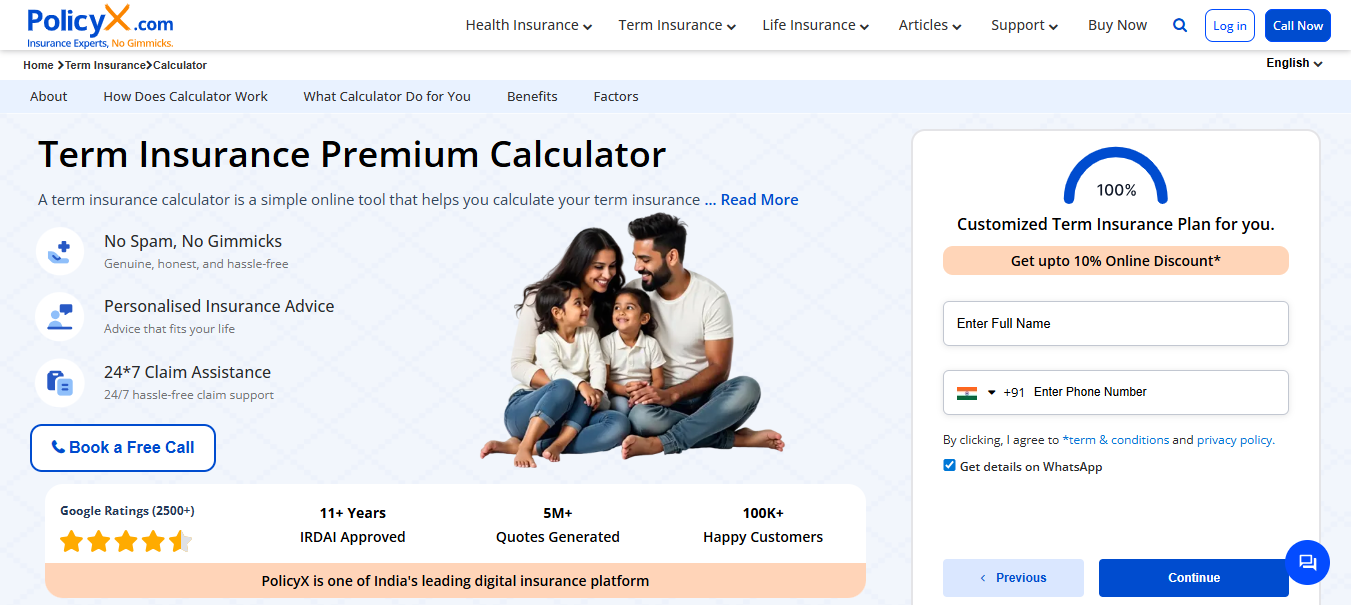

11+ Years

IRDAI Approved

5M+

Quotes Generated

100K+

Happy Customers

PolicyX is one of India's leading digital insurance platform

PolicyX Exclusive Benefits

No Spam

No Gimmicks

Personalised

Insurance Advice

24�7

Claim Assistance