- Benefits of Renewing Term Insurance Timely

- Disadvantages of Non Renewal

- Revival of lapsed policy

Buy Policy in just 2 mins

2 lakh + Happy Customers

Free Comparison

Term & Life Insurance

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Insurance & Business

Naval Goel, the founder of PolicyX is a well-recognised name in the Indian insurance and finance industry. His global overview has revolutionised the way insurance is perceived and bought by commoners in India.

Updated on Apr 08, 2025 4 min read

A Term Insurance policy's main goal is to provide financial security to your family in the event of your death. If you don't renew your policy when it matures, your family will lose the protection you've been paying for, all this time. The aim of Term Insurance is effectively defeated by Non-Renewal of the policy.

Renewal does not require a medical exam which means that your medical history will have no bearing on the policy's renewal. When a policy has to be renewed, the Insurance Provider renews it without any additional conditions.

Renewing the Term Insurance Policy is a must for every individual. However, if you do not pay your premiums timely, your Insurance policy will lapse, leaving your family with no financial security in your absence. Renewal of Term Insurance plan provides an opportunity for the policyholder to extend the coverage as per your requirements and age.

Following are the reasons why Term Insurance Renewal is important:

Tax Benefits

Term insurance offers Tax Exemption of up to 150,000 INR under section 80C of the Income Tax Act. Additionally, add-on covers such as critical illness cover provide Tax Exemption up to 25,000 INR under section 80D of the Income Tax Act. Renewing your Health Insurance on time ensures that you can continue to avail of Tax Benefits.

Premium Amount

The premium remains the same when you renew your policy on time. Not renewing your Term plan on time leads to a hike in the premium amount due to an increase in age, changes in medical history, etc.

Medical Test and KYC

If you renew your policy, then you don't have to submit the KYC documents again. Also, there would be no need to undergo a medical examination all over again.

Defeats the Main Purpose of Insurance

The biggest drawback of not renewing the policy is that the policy coverage will lapse. If you do not renew your policy on time, then the beneficiary will not get any stipulated benefits of the policy.

Discontinuation of Term Plan Benefits

If you don't pay the premium on time, your family will not get any Death or additional Rider Benefits and all the previous paid premiums will become meaningless.

No Tax Benefits

If you do not renew your Term Insurance policy, you will not get any Tax Benefits under the Income Tax Act. Premiums of term plan are eligible to provide tax exemption of up to 150,000 INR under section 80C of Income Tax Act, 1961.

Claim Filing

If you do not renew your policy on time and your policy lapses, it may not be possible for you to file a claim and the beneficiary will not get any sum assured in case of any mishap. Not renewing the policy defeats the entire purpose of buying Term Insurance.

Check and compare plans from 21 IRDAI-approved term insurance providers before purchasing a term plan.

When a person forgets/fails to pay the premium, the policy lapses. Normally, every policy has a grace period that varies from 15 to 30 days. However, if the premium is not paid within the grace period also, then the policy lapses automatically.

Whether to renew a lapsed Term Policy or get a new one depends on the circumstances & your needs at the moment. However, you should not make your decision just on the basis of the premium amount; instead, you must choose a policy that meets your current requirements.

The below-mentioned table represents few differences between reviving a lapsed policy and buying a new policy, which shall help you make a calculated decision.

| Revived Policy | Buying new policy |

| 1. You will get cumulative benefits like No waiting period, etc. | 1. You have to start from the scratch, & you would not be able to avail of the Cumulative Benefits. |

| 2. Medical Examination is not required. | 2. Medical Examination is mandatory. |

| 3. You will get the benefit of full tenure of the Term Plan. | 3. You will lose the benefits of full tenure of the Term Plan. |

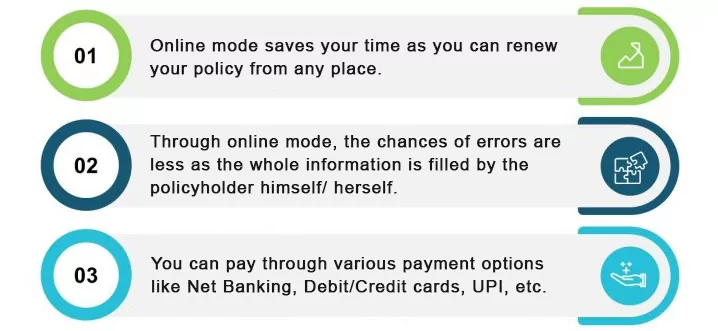

You can renew your policy from the official website of the company or through PolicyX.com.

I. Through Company's Official Website

II. Via PolicyX.com

It is important to Renew your Term Insurance without any interruption. Insurers remind customers about the renewal dates of Term insurance online as well as offline. The policyholder should stay up to date on renewal dates and make payments on time. Through the company's official website, you can make the payments easily & in a hassle-free manner.

You must renew your Insurance Policy on time to get the maximum benefits and for the continued safety of your loved ones.

1. What are Renewal Premiums?

Renewal Premiums are the premiums that are paid by the policyholder to the Insurance Company in order to keep the plan operational.

2. What if you do not succumb to death within the policy tenure?

If the policy tenure gets over & the policyholder does not succumb to death during the time period, the Insurance Plan will come to an end at the end. If there are any Survival Benefits, they are made available to the policyholder. You can also renew the policy to continue Life Insurance protection, depending on the Terms & Conditions of the insurance company.

3. Why is Term Insurance important?

A term plan is important for the following reasons:

4. Can the premiums change after a period of time?

It depends on various factors like the declaration of habits like smoking, drinking, or addition of riders, etc.

See More Term Insurance Articles

See More Term Insurance Articles

4.6

Rated by 884 customers

Select Your Rating

Let us know about your experience or any feedback that might help us serve you better in future.

Naval Goel is the CEO & founder of PolicyX.com. Naval has an expertise in the insurance sector and has professional experience of more than a decade in the Industry and has worked in companies like AIG, New York doing valuation of insurance subsidiaries. He is also an Associate Member of the Indian Institute of Insurance, Pune. He has been authorized by IRDAI to act as a Principal Officer of PolicyX.com Insurance Web Aggregator.

✖

✖

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Your call has been scheduled with Policyx for term insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata

Do you have any thoughts you’d like to share?