- Affordable premiums

- Tax benefits

- Flexible policy term

Get the Right Insurance Plan for You

Get upto 15% Online Discount*

Insurance Experts

No Gimmicks

- No Spam

- No Mis-Selling

- No Pushy Sales

Buy Policy in just 2 mins

2 lakh + Happy Customers

Free Comparison

Get the Right Insurance Plan for You

Get upto 15% Online Discount*

Term & Life Insurance

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Health Insurance

Raj Kumar has more than a decade of experience in driving product knowledge and sales in the health insurance sector. His data-focused approach towards business planning, manpower management, and strategic decision-making has elevated insurance awareness within and beyond our organisation.

Updated on Apr 08, 2025 4 min read

LIC’s online services is a step towards offering the best services through the website to LIC of india policyholders. One can easily register in the LIC web portal to access and enjoy the e-Services provided by them. To meet every customers’ requirements, many online facilities have been launched by LIC. One of the significant feature is the ’LIC Online Login Process’, from which you can register yourself for LIC online services. All you need to do is to create an User ID and Password from the LIC web portal to login to your account and get the necessary information related to your policy.

Every individual holding the LIC policies should use the LIC Online Login Process provided by the corporation as it is very simple and hassle-free.

But why are you wasting your time in the long queues? Why are you calling them again and again, when you can simply get the desired information by logging into the official website of LIC.

The online portal allows you to get all the required services from the comfort of your home. With such great services in hand, why to waste time in the long queues? LIC Online Login Process also saves a lot of time and money indeed. Let’s have a look to the whole login process of LIC in this article that will help you to understand and practise the same smoothly without facing any complications.

LIC’s online portal is an important and helpful initiative by the Life Insurance Corporation of India that provides on-demand service within a few clicks. Now you can access many services online for which you need to visit the branch office earlier. With these services you don’t have to visit the branch office or stand in long queues to get your work done.

Additionally, you will get several extra benefits and updates about the company and policies. You need first to register yourself in the online portal of LIC. Registration of online portal is mandatory to access the Lic’s e-services.

By logging in to the account in LIC’s online portal, one can make the most of the following online facilities:

All existing LIC policyholders in India can easily get themselves registered under the online services of LIC without paying a single penny. Additionally, LIC offers an amazing feature that allows the insured person to add the name of the spouse and child for registration. One can do an individual registration along with their spouse and children, this reduces the hassle of registration in the website separately.

Online Registration Can Be Easily Done On The Company’s Website: www[dot]licindia [dot]in

Nevertheless, individuals shall be allowed to register for the purchased policies only i.e., the ones they have owned in their name or their minor children name. On acquiring the age of 18 years of the children, unique user IDs shall have to be created if they want to continue avail the e-services of LIC policies approved in their names.

Couples who are married can register their policies together in the same account. Both the husaband and wife can log in to the same using his/her unique User ID and Password on the LIC portal.

Below is the step-by-step process to login and register as a fresh user to check your policy status online:

Step 1

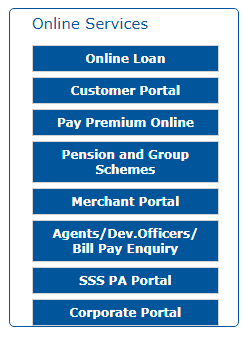

First login to the LIC’s official website (www[dot]licindia[dot]in) and select the ’Customer Portal’ tab which is there under ’Online Services’ or ’e-Services’.

Step 3

Submit your policy details that includes Policy Number, Premium Amount, Date of Birth, etc. to complete the registration process. After this, click on the ’Proceed’ button.

Step 4

Now it’s time to create a new ’Username’ and ’Password’ for the completion of the LIC online registration process.

Step 5

Now, you can login with the new ’Username’ and ’Password’. Click on the ’Submit’ button.

Step 6

Register your policy and get the required details from the tab ’Enrol Policies’ that is available on the left-hand side of the screen. Select the ’View Enroled Policies’ option.

Step 7

Verify the ’Captcha’ to check the status of registered policies.

Step 1

Simply login to the LIC’s official portal (www[dot]ticindia[dot]in) and under ’Online Services’, click on the Customer Portal’

Step 2

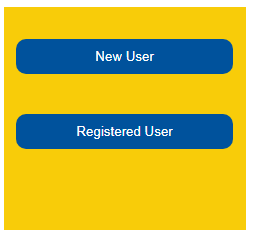

The above step will take you to the ’LIC’s e-Services’ page where you have to click on the ’Registered User’ button.

Step 3

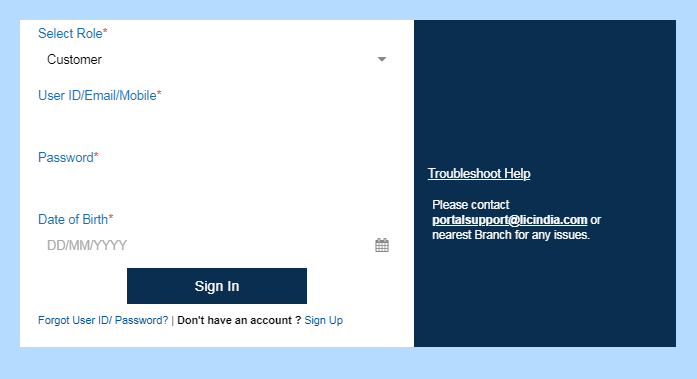

Choose ’Customer’ as your role, and fill the required details such as ’User ID/Email/Mobile’, ’Password’ and ’Date of Birth’ to Sign in.

Step 4

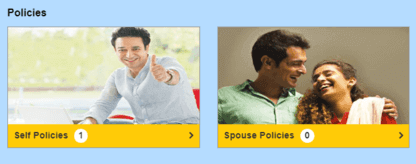

Click on the ’Self Policies’ option on the ’Customer Portal’ to check the full details.

*Note: Remember that if your premium is due, then you have to choose the option of ’Pay Premium’. Else the option of ’premium due date’ will be pop-up on the screen.

Step 5

Choose and click on the ’Pay Premium’ option to proceed further and fill the required data.

Step 6

Select the payment mode and make your selection from Credit Card, Debit Card or Net Banking and complete the transaction.

| LIC’s Website Payment Modes | Net banking | Credit card | Debit card | - |

| Authorized Banks | Axis Bank | Corporation Bank | - | - |

| Franchisees | AP online | MP Online | Suvidha infoserve | Easy Bill pay |

| Merchant | Premium Point agents | Life-Plus (SBA) | Retired LIC employee collection | - |

*Last Updated on 09-02-2021

We hope that the explanation of the process of making Lic online premium payments with the above steps by registering online is helpful. Now, let’s explore how you can make payments without registration.

Step 1

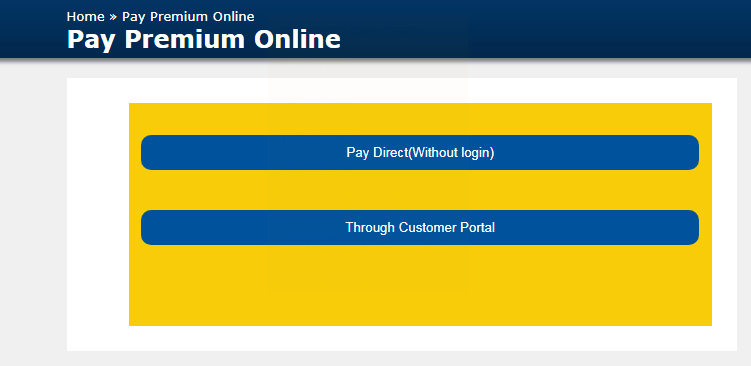

Simply visit or login to the LIC’s official website (www[dot]ticindia[dot]in) and select the ’Pay Premium Online’ option.

Step 2

You will be directed to a page where you will have two options to proceed— ’Pay Direct’ and ’Through Customer Portal’. At this stage, you need to choose the ’Pay Direct’ button.

Step 3

Now create a ’Username’ and ’Password’ that will complete the entire registration process.

Step 4

Login with the new username and password then press ’Submit’ button.

Step 5

You need to register the policy and check the desired details of your policy from the ’Enrol Policies’ tab. Just select ’View enroled Policies’ to complete the process and to see the status, enter and confirm the ’Captcha’.

There are multiple things that we have to keep in mind in daily life, so forgetting a User ID and password of LIC account is a common thing. But it doesn’t mean that you have to face many issues to login to LIC’s website. The retrieving process for username and password for the LIC account is very simple and hassle-free.

Step 1

Visit the LIC’s official website (www[dot]licindia[dot]in) and select the ’Customer Portal’ tab under ’Online Services’.

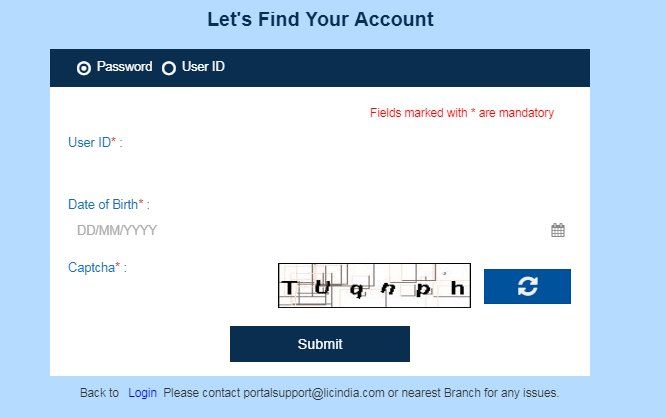

Step 4

With the ’Forgot Password’ option selected, enter your ’User ID’ and ’Date of Birth’.

Step 5

Fill out correct ’Captcha’ and then click on the ’Submit’ button to proceed.

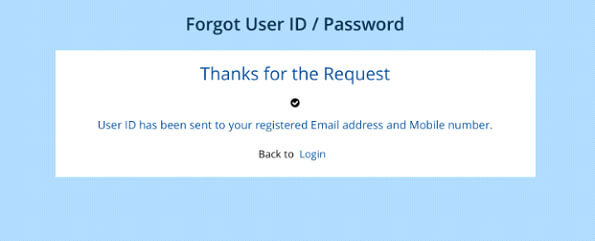

Step 6

After submitting, the ’password’ will be sent to your registered e-mail id and mobile number from where you can recover the same and back to ’Login’ with your new ’password’.

*Note: The ’Policy Number’ and the ’Date of Birth’ should match with the registered policy number and date of birth respectively.

Step 1

Visit the LIC’s official website (www[dot]licindia[dot]in) and select the ’Customer Portal’ tab under ’Online Services’.

Step 2

On clicking ’Customer Portal’, you will Land on the ’LIC’s e-Services’ page, choose the ’Registered User’ button.

Step 4

Choose the ’User ID’ option, enter your ’Policy Number’, ’Premium’ and ’Date of Birth’.

Step 5

Enter the correct ’Captcha’ and then click on the ’Submit’ button to proceed.

Step 6

After submitting, the ’User ID’ will be sent to your registered e-mail id and mobile number from where you can recover the same and back to ’Login’ with your new ’User ID’.

Once login to your account you are good to go with all the info of your policy!

LIC login access is an essential feature that can be utilized for various services. We hope that the information is useful and feasible and the entire concept of LIC login and registration is clear. You can check the policy status online, bonus status, premium due calendar, claim history, and make premium payments through credit/debit cards or through any other online modes for payment. After logging in to your account in LIC web portal you will find all the information on the page along with the precise statistics according to your convenience. Hence, with the help of the stepwise instructions and details mentioned in the article, you will be able to use LIC’s services easily from the comfort of your home.

Jeevan Akshay- VII (Table No. 857) is a single premium, non-linked, and non-participating immediate annuity plan. It pays annuity or pension to the po...

Unique Features

LIC Nivesh Plus is a unit-linked, non-participating, and single-premium individual life insurance plan. It offers insurance cum investment benefits th...

Unique Features

LIC Bima Shree Policy is a traditional, non-linked, and with-profit money-back life insurance policy that features guaranteed additions to provide sec...

Unique Features

LIC SIIP is a unit-linked non-participating individual life insurance plan. The plan comes out as an opportunity to monetize the investment options of...

Unique Features

LIC Navjeevan is a newly launched plan by the Life Insurance Corporation of India. It is a non-linked with profit endowment assurance plan. It is a co...

Unique Features

LIC has been very dynamic in introducing plans according to different individuals' demands. The LIC Komal Jeevan Plan is exclusively fabricated for ch...

Unique Features

LIC Micro Bachat Plan (Table No. 951) is a traditional, non-linked, participating micro-insurance plan that offers dual benefits of protection as well...

Unique Features

LIC Jeevan Saathi is basically an endowment assurance policy that is there to ensure the lives of husband and wife. It offers the required financial p...

Unique Features

Life Insurance Corporation (LIC) is an Indian insurance company owned by the Government of India. It was founded on 1st September 1956 and is headquar...

Unique Features

(A Perfect Gift For Your Beloved Daughter) LIC Kanyadan policy is the perfect financial coverage for your daughter with a very low premium. Unlike oth...

Unique Features

Pradhan Mantri Vaya Vandana Yojana is a single premium payment pension plan. This pension plan offers an option to either choose the amount of pension...

Unique Features

LIC Jeevan Saral is an Endowment Assurance plan under which the proposer has simply to choose the amount and mode of premium payment. The plan comes o...

Unique Features

It is a traditional endowment with death and maturity benefits to the policyholder. Even a bonus facility is given along. In this plan, the premium is...

Unique Features

LIC New Endowment Plan-one of the best policy by LIC India. The LIC New Endowment plan (Plan No: 914) is a must-avail plan considering the many benefi...

Unique Features

For the financial security of children and families, the LIC Jeevan Lakshya Plan (Plan No: 933) is the most suitable one. It is a collection of saving...

Unique Features

LIC Jeevan Rakshak Plan (Table No. 827) is a participating non-linked plan that provides a combination of insurance and savings. As the name suggests,...

Unique Features

LIC New Jeevan Anand is a participating non-linked plan providing a combination of both protection and savings. The plan offers financial protection a...

Unique Features

LIC Jeevan Umang (Plan No: 945) is a conventional, with-profit, non-linked endowment plan with complete life insurance coverage. The policy provides t...

Unique Features

LIC’s Aadhaar Shila Plan (Plan No: 944) is a non-linked insurance plan, with profits and a regular premium-paying endowment plan. This plan is a...

Unique Features

LIC's Aadhaar Stambh Plan (Plan No: 943, UIN: 512N310V01) is a non-linked insurance plan, with profits and a regular premium-paying endowment plan. It...

Unique Features

Of the many efficient plans of LIC, the Jeevan Shikhar Plan stands out in terms of benefits and simplicity of terms. The endowment plan was initially ...

Unique Features

LIC Jeevan Akshay VI Plan is an immediate annuity pure pension plan for senior citizens provided by one of the top ranked insurance companies in India...

Unique Features

The LIC New Money Back Plan 20 Years (Plan No: 920)was floated on January 6, 2014 to cater to the financial needs of the business and the salaried cla...

Unique Features

LIC Jeevan Shagun is a non-linked, participating, savings with protection single premium Money-Back plan. The policy provides high life cover in the e...

Unique Features

When it comes to offering a complete insurance suite of the most comprehensive financial security in terms of health and life, you are in safe hands w...

Unique Features

LIC launched the Bima Diamond Plan (table No. 841) on September 19, 2016. This is a non-linked plan, i.e. it doesn't depend on the share market. It is...

Unique Features

Ever come across a large pile of banknotes? You know, by winning the lottery or hitting the jackpot at your favorite casino? Your first instinct must ...

Unique Features

The future of the world depends on the strength of the children today. But if they are not prepared for that purpose, the dream will be unattainable. ...

Unique Features

LIC's Jeevan Tarun is basically a participating non-linked limited premium plan that offers a great combination of protection along with savings for y...

Unique Features

This plan has double roles to play. Firstly, this plan is applicable for safeguarding a family after the untimely death of the policyholder. Secondly,...

Unique Features

LIC Jeevan Labh (Plan No: 936) is a limited premium paying, non-linked (Not dependent on equity-based funds and money/share market) with-profit endowm...

Unique Features

Visit the official website of LIC and click on the ’Forgot User ID’ link. Then provide details such as the policy number, premium amount payable, date of birth and verify the given captcha. Click on ’Submit’. You will be able to retrieve your user ID.

First login to LIC e-portal - ebiz.licindia.in. Check the number of options on the left-hand side. Click Enroll policies. A new page opens and you are able to see the policies that are already linked to his account. Below this, there is another link for “enrolling new policies”.

You can check details of your LIC policy including details of the LIC premium payment online, accrued bonuses, group schemes, etc. by simply logging on to the official website of LIC India with your LIC login credentials.

Compare and buy the most suitable Life Insurance Plan from the below-mentioned IRDAI-approved Life Insurance companies.

4.6

Rated by 854 customers

Select Your Rating

Let us know about your experience or any feedback that might help us serve you better in future.

Himanshu is a seasoned content writer specializing in keeping readers engaged with the insurance industry, term and life insurance developments, etc. With an experience of 2 years in insurance and HR tech, Himanshu simplifies the insurance information and it is completely visible in his content pieces. He believes in making the content understandable to any common man.

You May Also Know About:

✖

✖

Our experts will provide you with guidance and address all your concerns within 30 minutes.

Note: Choose your desired date and time slot and our expert will get in touch with you shortly.

In case you have not found your desired slot, you can visit at website and use the Request Call Back option.

You are just one step away from getting insurance.

Policyx offers a completely spam-free experience. We will never contact you unless you request us to do so.

Your call has been scheduled with Policyx for term insurance.

Talk to an advisor

February 5, 2023

Asia/Kolkata

Do you have any thoughts you’d like to share?